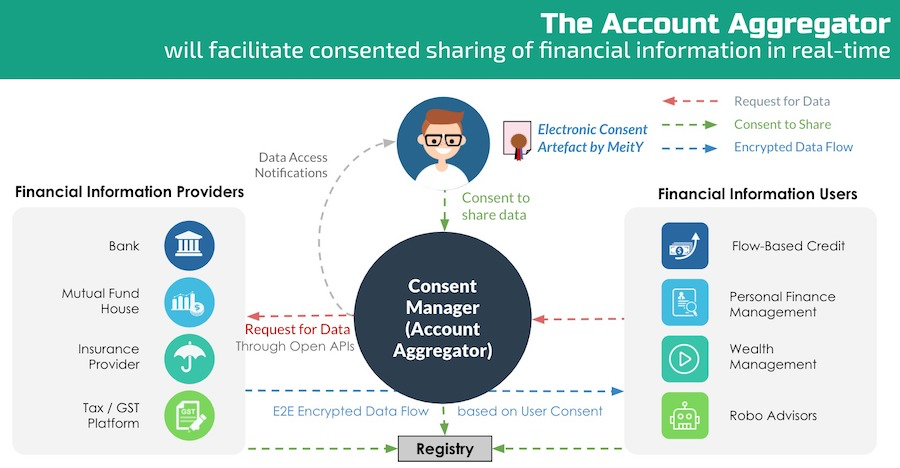

The Account Aggregator (AA) framework provides a digital platform for easy sharing and consumption of data between Financial Information Providers (FIP) and Financial Information User (FIU) with explicit user consent.

In line with the provisions of the Data Empowerment and Protection Architecture (DEPA) policy, AAs give Indian consumers complete control over how their personal data is used and enables the large scale transfer of consumer data over a secure, encrypted channel.

Banks, NBFCs, and other lending institutions can leverage the AA ecosystem to address the following use cases and more:

1. Lending

The new system will help process more loan applications in a lesser time, and DERISK loan books by getting financial data directly from the source. Error-prone back-office practices such as screen scraping will make way for secure, high-speed consumer data delivered directly to the lenders via Account Aggregators.

In conjunction with the upcoming Public Credit Registry (PCR), the AA framework enables lenders to offer sachet sized loans based on business cash flow.

2. Loan monitoring

This will also solve the need to monitor loan accounts post-disbursement for early intervention and lower loan loss provision., which will be a significant step-up from the traditional manual credit assessment process.

3. Wealth management

Thanks to AAs, wealth managers can devote more time on expanding their customer base while technology aids them in their day to day operations.

FIP/FIU modules are required to connect Bank/NBFC’s existing technology solutions to the Account Aggregators in the ecosystem, to address above mentioned use cases.

As a technology service provider for the AA ecosystem, Finezza is well-positioned to expedite the development and certification of FIP/FIU modules for speedy onboarding of Bank/NBFC to the AA ecosystem.

To know more, get in touch with us today!