Appropriate authentication of loan documents is crucial not only to the business but also for building trust in the lending relationship. However, overwhelmed by the heap of documents, one often ends up missing out on an important piece of paper. The consequence? Varies from wasted time and effort to a dire loss.

The Problem

Manual, paper-based loan processing of consumer and commercial loans causes exceptions or errors which are costly and time-consuming to correct, create a negative customer experience, and lead to downstream legal and compliance risks.

Our Solution

Digitise loan process and deploy e-signatures for straight-through processing of loans. No walking back and forth; a streamlined documentation process and electronic data verification make the loan approvals quick and effortless.

The Outcome

Apart from the usual benefits of technology, electronic verification allows the lending process to digitise completely. Here are the advantages it grants:

- Reduce unintended errors and document handling costs

- Decrease future risk with thorough verification

- Improve customer experience by eliminating delays and inconvenience

- Improve loan employee performance

A digitised lending process will facilitate ease of business, provide greater reach by removing the physical barriers, and improve the entire financial system.

How it Works

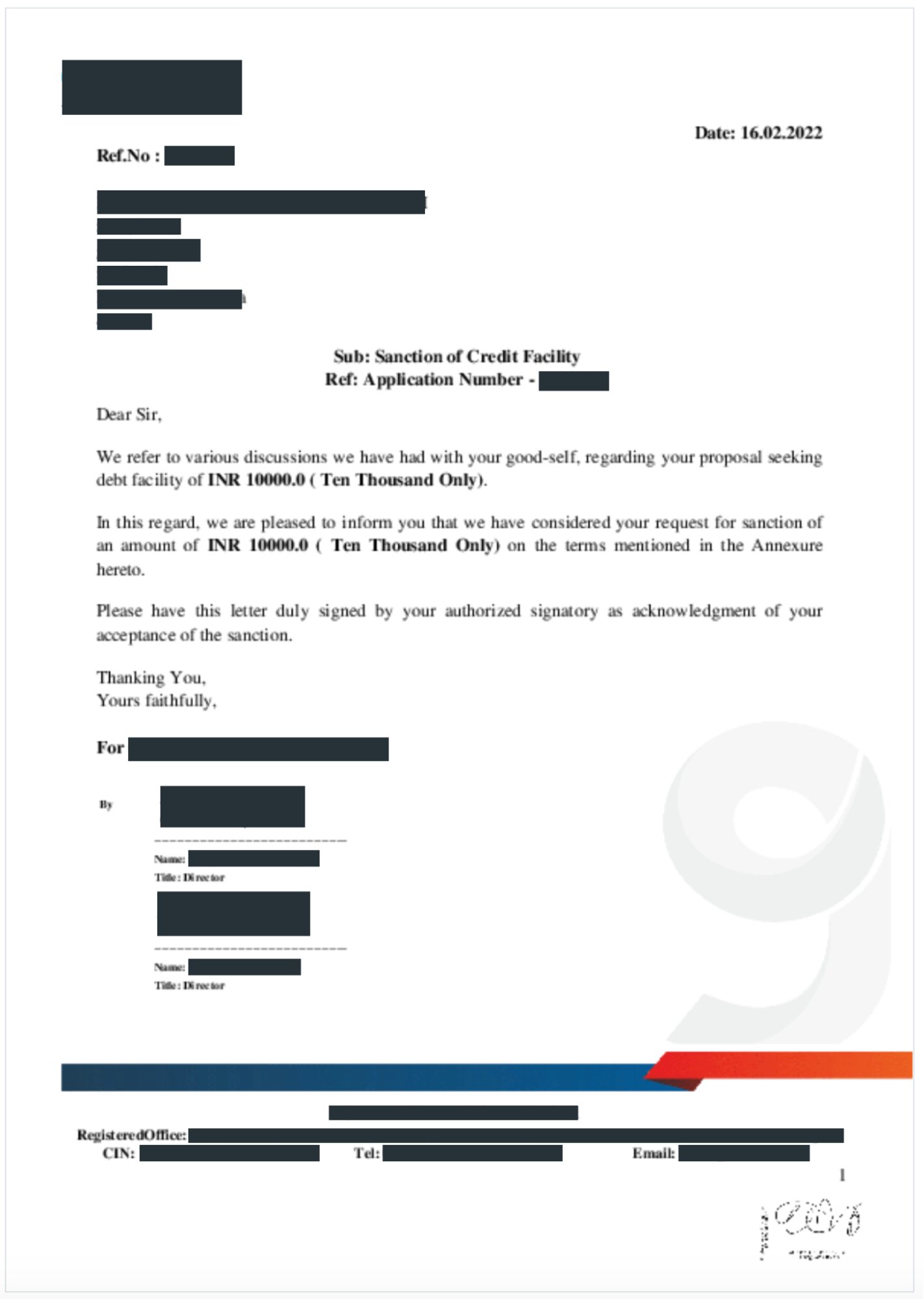

As a part of the lending business, it’s needless to say that one has to be sure in every step of the game. Albeit the digitisation of the lending process, the people involved remain the same. But with layers of security, e-signature verification ensures that the recipient willingly agrees to the deal, just as good as a physical signature.

Here’s the new lending process in action:

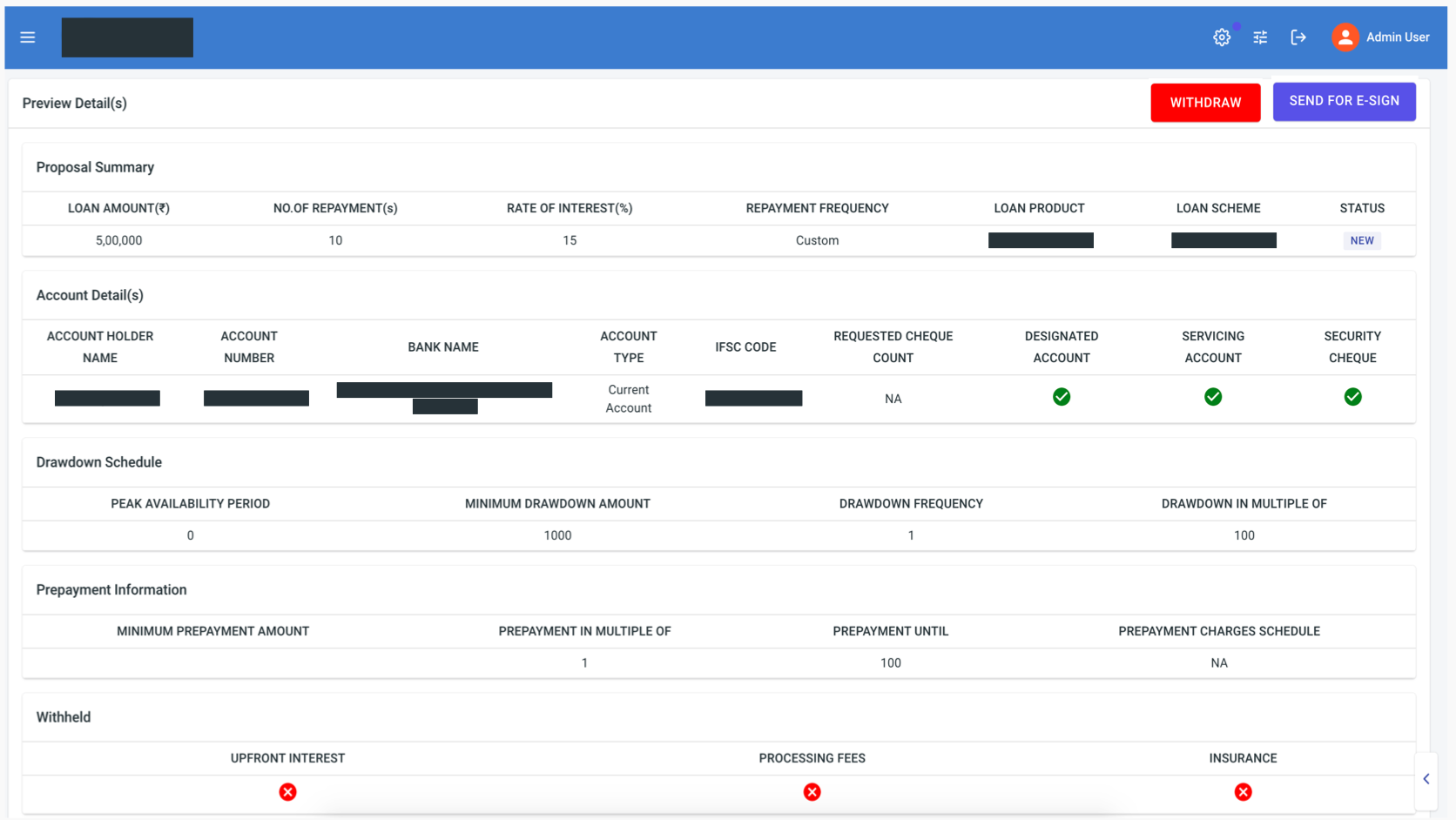

- After a customer applies for a loan using the financial institution’s channel, the loan officer reviews the application, generates a proposal, and sends it for e-signing via the loan origination system.

- The loan origination system hands over the proposal document and other customer data to Digio.

- Digio platform then takes over by executing the entire transaction electronically, from start to finish. This process includes preparing the document for e-signature, sending the document link to the customer via SMS (or other communication channels as desired by the financial institution), OTP verification, presentation, signing, and returning of signed loan document to the loan origination system.

A facile yet standardised approach, from application to approval.

The Takeaway

Despite the scepticism e-signatures faced at their inception two decades ago, they are now a boon to the finance industry altogether. Being an inseparable part of Fintech, electronic authentication has made financial transactions, from taxation and returns to loans and banking, quick, convenient, and secure.

To ensure a seamless lending process, Finezza offers a complete Loan Management Solution. Contact us to make better decisions and level up your lending business.

Leave a Reply