Loan origination has evolved from a paper-heavy, weeks-long process to a digital-first experience where borrowers expect instant decisions and transparent communication. As borrowers become accustomed to real-time digital services, expectations around speed and transparency are reforming lending standards. The global digital lending platform market was valued at USD 10.55 billion in 2024 and is projected […]

5 Loan Management Software Trends Shaping the Future of Digital Lending

Loan management software (LMS) has been quietly transforming the lending landscape, improving borrower experiences and operational efficiency among lenders. At present, the uptake of digital LMS is witnessing exponential growth driven by advances in technologies, including artificial intelligence (AI), predictive analytics, data analytics, robotic process automation (RPA), and machine learning. As consumer expectations and financial […]

4 Warning Signs of Circular Trading in Bill Discounting: How to Prevent It

The financial compliance landscape is complex and requires a perfect balance between regulatory requirements, reporting, risk management protocols, and efficient transaction tracking systems to combat financial crimes. Circular trading in bill discounting is a common tactic used by fraudsters or criminals to hide or mask the source of their illicit funds. Therefore, it is crucial for […]

AI-Powered Invoice Financing: Streamlining Manual Processes

The RBI-backed TReDS platform financed 41.6 lakh invoices through invoice discounting in FY 2024. It was worth ₹1.38 lakh crore. Over the past five years, invoice financing has jumped 766%, while the value of funds unlocked for MSMEs grew 1,138% from ₹11,165 crore. Despite its potential, many lenders still depend on manual verification processes and […]

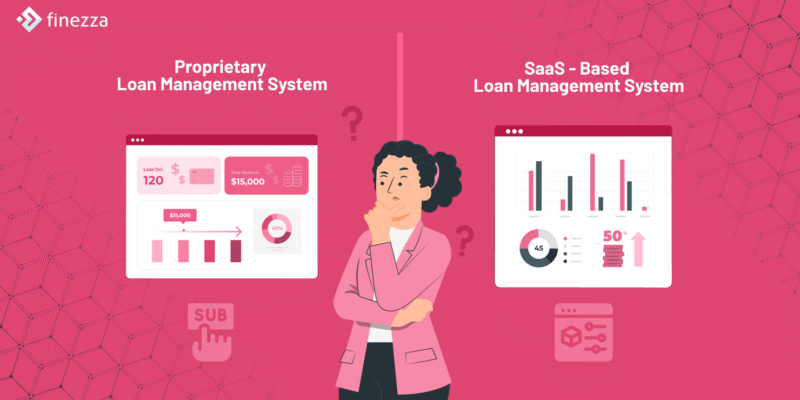

Proprietary vs SaaS-based Loan Management System: What Suits Lenders Better?

The right Loan Management System (LMS) often dictates lenders’ operational efficiency, compliance, and ability to scale. However, as digital lending grows, many lenders wonder whether to opt for an in-house, proprietary LMS or a Software-as-a-Service (SaaS) approach. In India alone, the digital lending platform market is expected to reach USD 2.38 billion by 2030, growing […]

Bias Detection in Automated Loan Processing: Ensuring Fair Lending Practices

India ͏has nearl͏y 500 million͏ a͏d͏ults without a formal cre͏dit͏ his͏to͏ry,͏ and digita͏l lend͏ing platf͏or͏ms using Automated Loan Processing now reach over 1͏50 mill͏ion of them. These p͏lat͏forms ass͏ess hundreds of ind͏ica͏t͏ors͏—income,͏ bill payments, mobil͏e usage—p͏rov͏idi͏ng loan dec͏isions with͏in ͏secon͏ds. Despi͏te͏ this, the re͏liance o͏n auto͏m͏ated decision-making introduces th͏e risk of unintentionally per͏petua͏ting e͏xisting s͏o͏cial […]