Treasury teams at NBFCs and small finance banks manually reconcile ALM data for 8-12 person-days monthly, extracting loan portfolios from LMS platforms, deposit schedules from CBS, and investment holdings from treasury systems. When RBI’s monthly ALM return (Form III) is due, this reconciliation window compresses to 72 hours, forcing teams to work through data mismatches […]

Why 35-40% of New Loan Officers Leave Within 60 Days (And How AI Helps)

Are you, like many lenders across the country, also facing a recurring challenge: a high attrition rate amongst loan officers? According to research, approximately 35-40% of new loan officers leave within the first 60 days of joining, due to a combination of factors. Each replacement costs lenders ₹2.5-4 lakh when accounting for recruitment, training, and […]

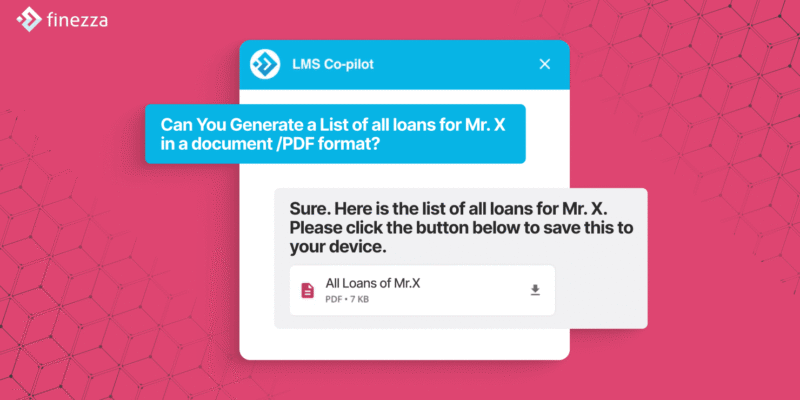

Natural Language Loan Queries: 5 Use Cases from Finezza Co-pilot

Loan officer asks: ‘What’s the outstanding balance on loan 208241?’ Four minutes later, after opening three screens, cross-referencing LOS and CBS data, and manually calculating interest accrued since last payment, they finally have an answer. Multiply this by 200+ daily queries, and 15 productive hours vanish into routine information retrieval. When 35% of new NBFC […]

NBFC Attrition is Over 75%. But One Technological Solution Can Help

NBFC attrition is over 75%. This isn’t just a statistic. It’s a crisis threatening your business. According to TeamLease Services (2025), NBFCs are experiencing 77% annual turnover, with loan sales teams facing monthly attrition of 9–13%. When your best people leave, so do customers, revenue opportunities, and efficiency. Despite this, many organisations continue relying on […]

Why Configurability, Not Just Features, Is the True Measure of Loan Management Software

Your loan officers waste three hours daily reconciling data between systems that should talk to each other. Collections teams maintain shadow Excel trackers because your LMS can’t handle product-specific penalty structures. Credit managers file change requests for business rule modifications that take six weeks to implement. These aren’t edge cases—they’re symptoms of prioritizing feature checklists […]

How NBFCs Reduce Loan TAT by 70% with Digital Lending Automation in 2026

NBFCs across India are preparing for a landscape where speed will decide survival, and delays will drive customers away. The recent industry studies predict that in 2026 over 82% of borrowers will choose lenders who offer fast approvals, while nearly 65% of NBFCs confirm that their biggest struggle is reducing Loan TAT. With rising application […]