There’s a lot of buzz going around embedded finance. It has surely emerged as a phenomenon in the last few years. If it is a challenge to traditional banking could be the next puzzle. Before we clear that air for you, let us look at the last financial year and what it has to say.

COVID-19 has a significant impact on existing banking models. The pandemic has had an unconventional influence on customer demand. For financial services, the technology that enables these demands is snowballing. Non-financial companies have increased their efforts and refined their techniques to provide their clients with offerings that address specific needs.

Both fintech and non-financial entities now offer precisely focused interfaces with the support of BaaS. As a result, embedded finance is poised to gain millions of clients by advancing financial democratisation. Now, Can embedded finance put a stern challenge to traditional banking? Let’s explore.

Important Embedded Finance Facts and Figures

For a wide range of business verticals, embedded finance opens up new potential in areas like tailored SaaS, markets, eCommerce, mobile, and telecoms. These aren’t only for industrial behemoths. They also give a fantastic business potential for local SaaS companies through the smooth integration of financial services with the help of BaaS suppliers.

Soon, we might see real-estate agents offering their customers mortgages upon buying a particular property without the hassle of liaising with a financial institution. Or a fitness app incorporating health insurance deals for the customers. It doesn’t mean every firm of the varied sectors should gear up for a full-fledged banking system. It is a mere provision of fintech to customers who seek service from that aspect. Conventional financial systems are lacking in these customer propositions.

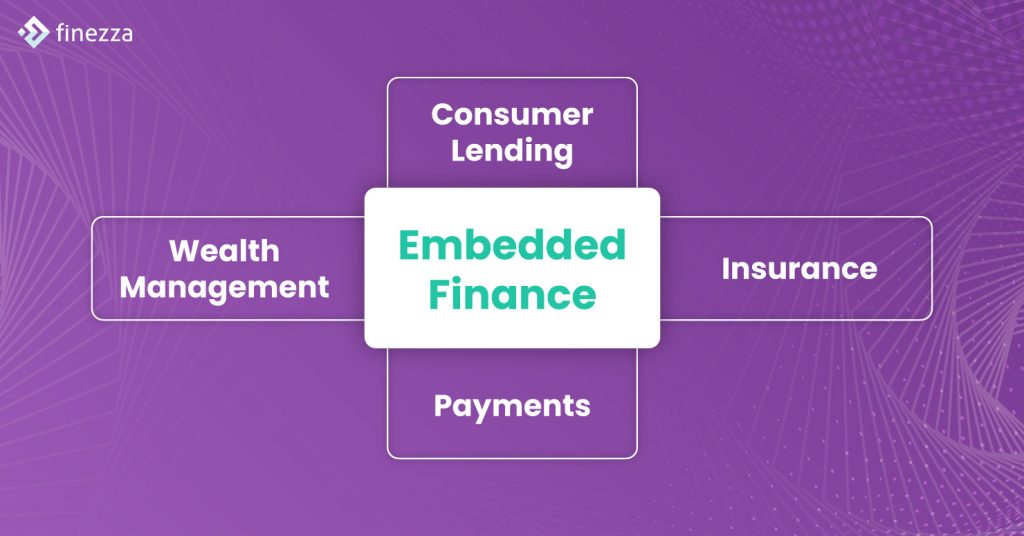

There are four predominant focus areas of embedded finance in 2021. Have a look.

The above significant areas are responsible for:

- generating a revenue of $2.6 billion for wealth management.

- CAGR is estimated to be $15.7 billion from $1.7 billion, a 62% increase in consumer lending.

- A predicted CAGR increase in insurance from $5 billion to a 62% development of $70.7 billion

- Payments have seen a colossal enhancement with 54% to $140.8 billion from $16.1 billion

The statistics and figures now put up a question, what drives this surge of embedded finance? Find the primary growth drivers of embedded finance below.

Customer Buying Pattern

There has been a transformation in consumer buying patterns with the advent of digitisation. It ushered in the digital platform market, which fueled a consumer-driven trend. That altered most adult generations’ purchasing habits and established a new standard for the youngsters. Amazon, Instagram, and Uber are some of the most well-known names.

A readiness to adapt

Many consumers are eager to use a non-traditional financial source to get banking services. A recent study by Cornerstone Advisors showed that 46% of individuals aged 26 to 40 years old are often checking if Amazon has started a financial product or service. Now, that is just one aspect of the entire spectrum.

Open to share

A survey says that the young population is comfortable giving personal information. With the data it collects from clients, Embedded Finance can create a customised user experience.

Now with these growth drivers, who can be the key players of this embedded finance ecosystem?

- Providers – A financial service providing suite will plug products, tools, and services into the platforms. These providers offer exquisite fintech development and management services through various products, tools, and services.

- Enablers – Enablers use technologies and platforms to make an existing system easier to use or improve. Banking as a Service (BaaS) companies rent out their core banking platform to ensure multiple fintech services and apps.

- Containers – Consumers always like access to financial services through a variety of channels. The channels include the web, mobile, and point-of-sale. Containers establish a link between the financial institution and customer data. Therefore, creating a platform for users to access end-to-end financial services.

Benefits of embedded finance

Why is embedded finance a challenge to conventional banking? Know the reasons below.

Convenient to the user

Mobile app development is the current focus of fintech firms to ease the user experience process across small to large enterprises. They are enhancing their banking capabilities with help from BaaS.

Frictionless payments

Ensuring an effortless experience with the embedded financial functioning on non-finance apps such as BNPL, QR code, rideshare insurance, and digital wallets, etc.

User experience

Developers are focussing on interfaces that are user-friendly to use a fintech product. Ensuring better customer engagement.

Conversions

Providing a user-friendly interface, enabling frictionless payments and convenience of use at every phase leads to better conversions.

Revenue

A better embedded financial product or service with integration across the platforms has multiplied the revenue generation by 5X times.

Now, let’s unveil the applications across the sectors.

Applications of Embedded Finance

The ability to offer a financial service being a non-finance entity is now possible with integrating multiple applications, tools, and software. Embedded finance has now become a disruptive trend in banking, payments, and technology. The development resulted in showing tremendous potential in redefining the financial services to both firms and customers.

- POS, vertical software vendors, eCommerce – Toast, Shopify, Lightspeed, and other sub-merchants benefit from Embedded Finance’s unified transaction and loan capabilities.

- Ridesharing: Companies like Uber offer both the customer and the driver financial services like instant pay, insurance, digital wallets, and debit cards.

- Customer-focused solution: Software tools and fintech apps are collaborating to focus on specific consumer needs. Thus, expanding their functionalities of apps through loan instalments, debit cards, instant lending, and so on. Few examples of this system are Klarna, Revolut, Square.

- Consumer tech firms: Technology biggies like Facebook, Apple, Amazon, Google, Telcos provide multiple fintech services. The popular functions are P2P payment services, digital wallets, debit cards, credit, and lending, etc., to their end-customers.

Embedded finance has evolved into a technology-enabled act of combative creation. Fintech firms around the world are attempting to capitalise on the advantages of integrated finance. They could now establish new business prospects, ideal experiences, channels, and solutions. Unlike traditional banking, embedded finance can change the way businesses operate. All industries across the sectors and domains must leverage this infrastructure to stay dominant with market competitors.

And, yes, embedded finance is providing a challenge to traditional banking. Lenders can benefit from higher margins. By partnering with digital mediums, they can gain a varied pool of customers in the market. Customers can now have affordable, seamless, and customized fintech services.

To have a financial service that can match all social demographics and economics, you need the right fintech service provider. Finezza offers efficient consumer-focused LOS & LMS solutions that adhere to the highest standards. The best part is their tech-focused approach. What embedded finance solutions do you need? Let us know.

Leave a Reply