After the runaway success of the Unified Payments Interface (UPI) mobile payments platform, India is moving forward with the next stage of digitising its financial services sector. The opportunities are immense but so are the challenges. Most Indian lenders have been hamstrung by a growing NPA burden and the focus has shifted to the underfunded SME and micro-lending segment. However, in the absence of access to real-time credit data, lenders have been unable to unlock its true potential till date.

The Rise of Open Credit Enablement Network (OCEN)

The credit gap in the MSME sector is estimated to be between $270B to $330B. Also, the cost of lending is too high for small value loans to be feasible, which keeps most small and mid-sized businesses out of the loop.

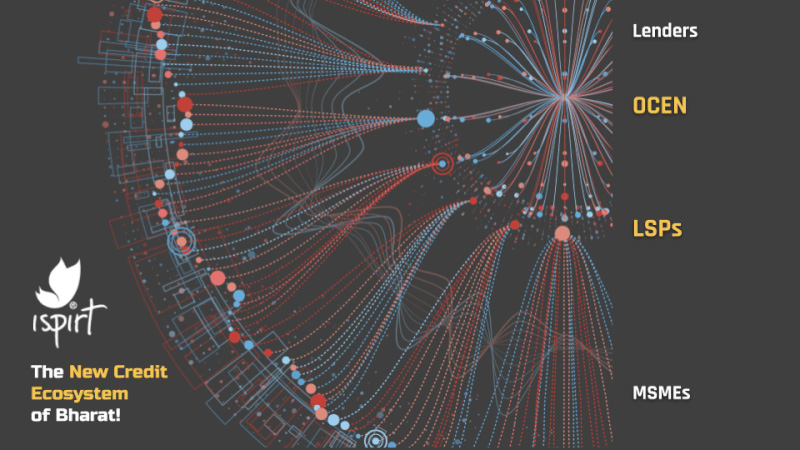

To address this problem, a common credit information framework is being developed to connect lenders, customers, and merchants under the Open Credit Enablement Network (OCEN) initiative.

O: Open – An open credit protocol.

CE: Credit Enablement – To enable credit for the underserved MSME sector.

N: Network – A network of lenders, account aggregators, and borrowers that will rely on the bandwagon effect.

Let’s take a look at how OCEN ecosystem can open up a new horizon in our financial landscape:

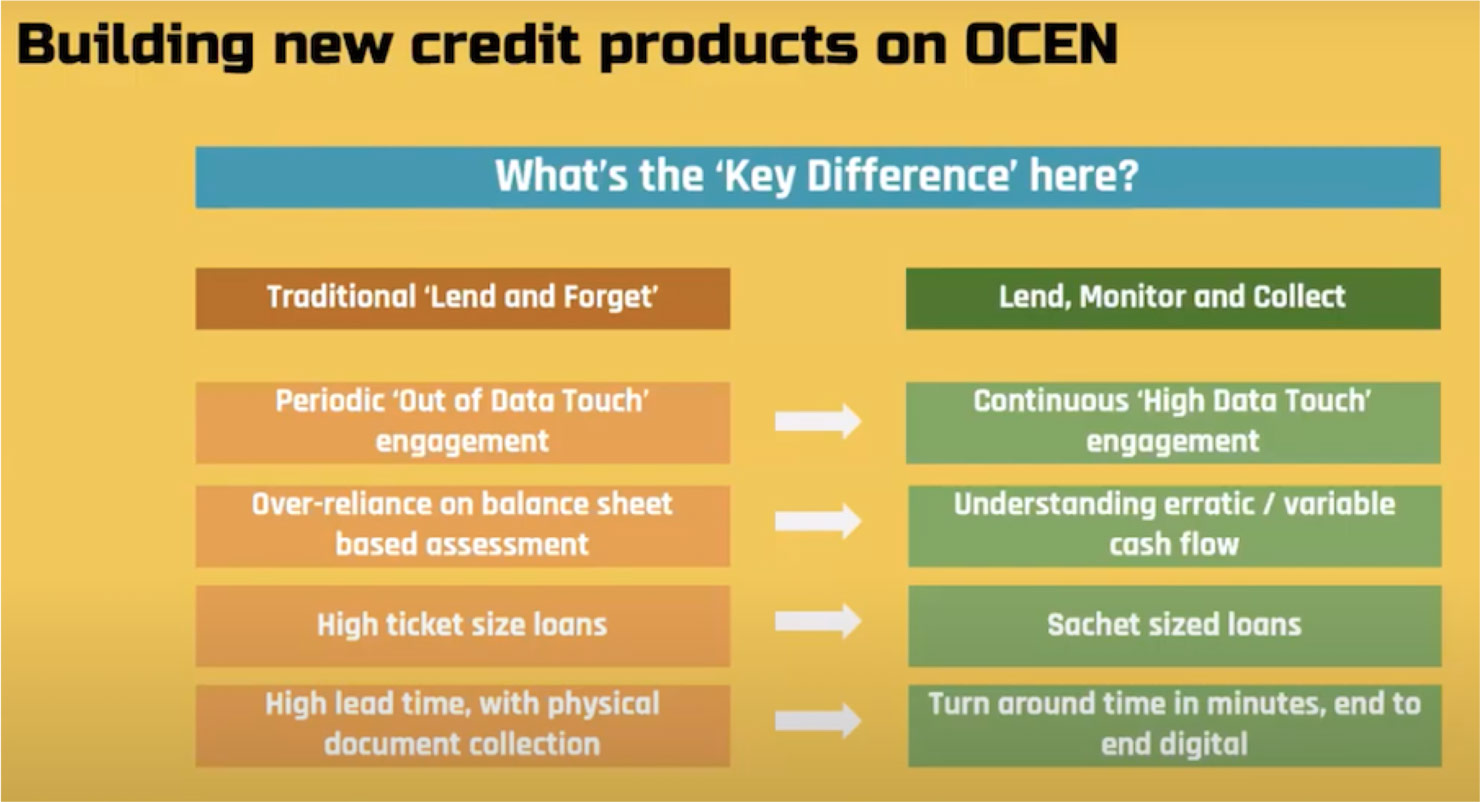

Addressing asset quality challenges

Simply put, OCEN is to lending what UPI was to mobile payments. It is an open protocol that will enable the smooth flow of consumers’ financial information from the point of purchase to financial institutions through dedicated data aggregators with the customer providing consent in real-time. This will, in turn, help lenders close down the gap in loan origination with customers getting the best possible quotes. OCEN will run on a secure digital platform and will be compliant with the strict data protection requirements of the Personal Data Protection Bill that was tabled in Parliament in 2019.

The technological foundation is proven. OCEN is the latest evolution of the India Stack, a framework that has made innovations like Aadhar/UID, DigiLocker, and UPI possible. Lenders will now be able to access customer credit information through a new category of NBFCs called Account Aggregators that will serve as the gatekeepers of credit data. Account Aggregators (AAs) will, in turn, source the data from a common public credit database that will integrate traditional and non-traditional credit data sources. OCEN will enable banks to closely monitor the spending behaviour of borrowers and take timely corrective action if there are signs of financial distress. Merchants will act as frontline loan service providers in partnership with aggregators and lenders.

For the first time, it will be possible for lenders to leverage data relating to consumer spending activity such as utility payments and tax data for loan underwriting purposes. Currently, credit bureaus do not include such data in their reports. This is likely to improve lenders’ ability to visualize risk better and improve asset quality over time.

Large scale democratisation of consumer credit information

The coronavirus pandemic has triggered a record drop in economic growth. Growth in demand for retail and business finance has already stalled and lenders have been looking for ways to control credit costs. With OCEN, credit data collection, and more importantly, market intelligence will become far more streamlined for lenders. It will lead to the democratisation of access to credit data throughout the lending value chain. This will help lenders predict market trends on a macro level and develop targeted products to meet emerging demand.

The lending industry operates in a tough regulatory environment. In the past, the RBI has cancelled the licenses of several NBFCs for failing to meet licensing norms and for violating the provisions of the Credit Information Companies (Regulation) Act, 2005. According to reports, the upcoming Personal Data Protection Bill makes provisions for penalties between INR 5 crore to 15 crore for minor and major regulatory violations respectively.

The lending industry operates in a tough regulatory environment. In the past, the RBI has cancelled the licenses of several NBFCs for failing to meet licensing norms and for violating the provisions of the Credit Information Companies (Regulation) Act, 2005. According to reports, the upcoming Personal Data Protection Bill makes provisions for penalties between INR 5 crore to 15 crore for minor and major regulatory violations respectively.

This will raise the stakes for banks and private lenders that are already struggling to remain competitive in an uncertain business environment. By leveraging standardised credit data, lending companies will be able to be proactive in their approach to compliance and risk management. Standardised data will also help reduce, if not completely eliminate, the need for extensive back-office processing which is currently driving up operating costs for lenders.

OCEN’s open API means that lenders can create seamless data pipelines with merchants or loan service providers, improving turnaround times. This will, in turn, directly contribute to better customer experience. From loan origination to account servicing, lenders can now look forward to deriving cost efficiencies that would simply not have been possible with traditional processes. In addition, insights from OCEN can lead to the development of better risk models.

Plugging existing gaps

OCEN will be the perfect test case for a host of similar frameworks in domains as diverse as insurance, education, and skill development. Its real-world impact is already being watched with great interest by countries such as Brazil. For Indian lenders, the confluence of e-KYC, online documentation, and instant credit verification through the various layers of India Stack will enable better economies of scale, improved utilisation of resources, and better margins.

In the era of open banking, lenders cannot survive without adopting a customer-centric business model. This means giving customers greater control of their bank accounts and other investments. With loan marketplaces enabling faster product discovery, some large banks have taken the lead in using data analytics to disburse pre-approved loans in under a minute.

With OCEN, the majority of lenders would be able to approve such loans in near real-time while ensuring complete compliance with credit guidelines. For smaller NBFCs, OCEN could level the playing field in terms of identifying new market opportunities, particularly in the Micro, Small, and Medium Enterprise (MSME) segment.

To take advantage of the new protocol, however, the only prerequisite is a compatible loan management system that can interface with the OCEN API. Most Indian lenders are well on their way to integrating technology into their lending workflows, however, the dubious quality of credit data had been a cause for concern.

By creating a universal credit data framework, the government has sought to uphold the interests of the lending community while giving consumers the widest choice of financing possible.

Conclusion

India is one of the market leaders in the areas of Fintech and data analytics. Despite this, the vast majority of Indians are credit deprived and forced to rely on informal sources of credit. From the farm sector to small traders, the business opportunities waiting to be tapped are extensive. The introduction of OCEN is likely to lead to better integration between lenders and marketplaces. With the number of lending channels increasing exponentially, however, lenders will need to embrace change and leverage partnerships effectively to innovate and grow.

Finezza is a leading lifecycle loan management and analytics platform that is built to deliver actionable insights across the credit value chain. It is designed to increase process efficiency, reduce operating costs, and improve decision quality in a seamless and sustainable manner for our customers. To know more about Finezza, get in touch with us.

Leave a Reply