The traditional banking setup has seen a complete overhaul with increasing technological advancements. It may seem like a new world, from loans in 59 minutes to digital wallets. All this has been made possible by embedded finance, which allows the integration of financial services into non-financial services. Its ecosystem is anticipated to grow at a […]

6 Ways Tech in Finance is Transforming Microfinance Institutions

The microfinance sector has evolved rapidly since Muhammad Yunus pioneered the movement around three decades ago. India, one of the fastest-growing economies in the world, banks on microfinance for sustainable growth and economic development due to the significant rise in the number of micro, small, and medium (MSMEs) seeking swift, organised, and streamlined access to […]

Challenges of Invoice Financing for Lenders and its Alternatives

There is usually a delay between the sale and receiving payment, which, for some businesses, takes longer to settle. To counter this issue, companies offer credit services to boost their sales, edge out competitors and build better customer relations. However, in the meantime, the business also needs to continue its daily operations as usual, which […]

Debt Factoring vs Account Receivable Financing: What To Choose?

Uninterrupted cash flow is the lifeline for all businesses; however, it is not uncommon for companies to have considerable gaps between a sale and receiving payment, which can disrupt their liquidity. As a result, ensuring smooth cash flow can be quite challenging for businesses, especially the ones that allow long credit periods to their customers. […]

Future of Credit Underwriting Software and its Impact on Business

In today’s digital age, credit underwriting plays an integral part in determining the financial viability of businesses and individuals. According to reports from Experian and Praxis Global Alliance, India reached an impressive milestone of USD 270 billion in digital lending in 2022. Disbursements also saw an uptick of 11%. To keep up with this growth, […]

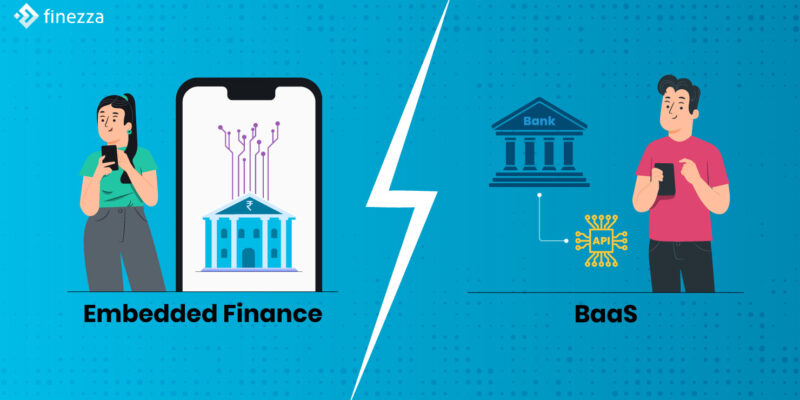

Embedded Finance vs BaaS: Differences Traditional Finance Service Providers Need to Know

Digitisation has influenced industries and consumer behaviour across the board; however, its impact on the financial services sector has been exceptional. For example, Embedded finance and Banking as a Service (BaaS) are two digital trends contributing to technology-led transformation in the banking sector. Often BaaS and embedded finance are mistaken to be the same as […]