Fintech startups are redefining the credit ecosystem—disbursing thousands of loans daily across various borrower segments. However, as volumes surge, traditional processes, reliance on spreadsheets, and disconnected systems begin to show their limitations. Start-ups that scale rapidly without a resilient technology foundation consistently face delayed disbursals, compliance loopholes, and restricted portfolio visibility. To sustain India’s forecasted […]

Foreign Exchange Risk Management in Study Abroad Loan Portfolios

With over 1.33 million Indian students studying abroad, education loans have become vital. According to an Economic Times report, 33% of these students depend on such loans to pursue quality education overseas. Non-banking financial companies (NBFCs) have seen significant growth in education loan assets, rising over 80% in fiscal year 2023 and 70% in fiscal […]

How to Integrate Customer Data Across Platforms for a 360° Lending View

Picture this: Most banks run 10-15 separate core systems, like loans, credit cards, and CRM, that do not communicate easily with each other. The result is fragmented data, duplicate customer profiles and siloed records. These issues obscure a borrower’s full financial picture. This silo problem is widespread. A 2024 survey found 57% of banking executives […]

Guide to AI-Powered Loan Management Software for Modern Lenders

Manual loan processes slow lenders down. In 2023, only 15 percent of lenders used artificial intelligence, but that number jumped to 38 percent in 2024. By 2025, Fannie Mae predicts 55 percent of lenders will pilot or expand AI. Relying on paper forms and fragmented systems means lost time, higher operational costs, and missed opportunities. […]

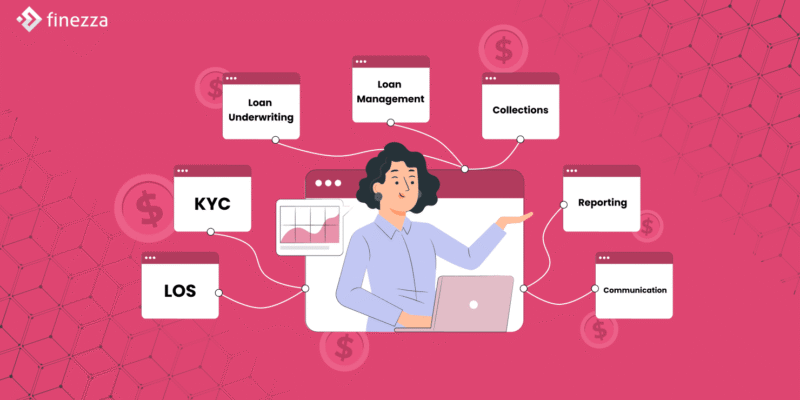

The Complete Lending Te͏ch Stack: 7 Critical Integration Categories Every Lender Needs

Lending these days is not about just giving out loans; you also need to build trust, speed, and accuracy in every interaction. According to the Invest India report, India’s digital lending market is projected to grow from $270 billion in 2022 to more than $1.3 trillion by 2030. Customers now expect fast approvals, simple onboarding, […]

The Future of Financial Accuracy: Implementing Automated Credit Bureau Solutions

What if one small reporting error could cost your bank millions? Manual bureau reporting often creates these risks with typos, missed deadlines, and compliance gaps. That is why more institutions now turn to automation. Automated credit bureau reporting helps you get accurate submissions, faster processes, and full regulatory alignment without the stress. For financial institutions, […]