Manual loan processes slow lenders down. In 2023, only 15 percent of lenders used artificial intelligence, but that number jumped to 38 percent in 2024. By 2025, Fannie Mae predicts 55 percent of lenders will pilot or expand AI. Relying on paper forms and fragmented systems means lost time, higher operational costs, and missed opportunities. […]

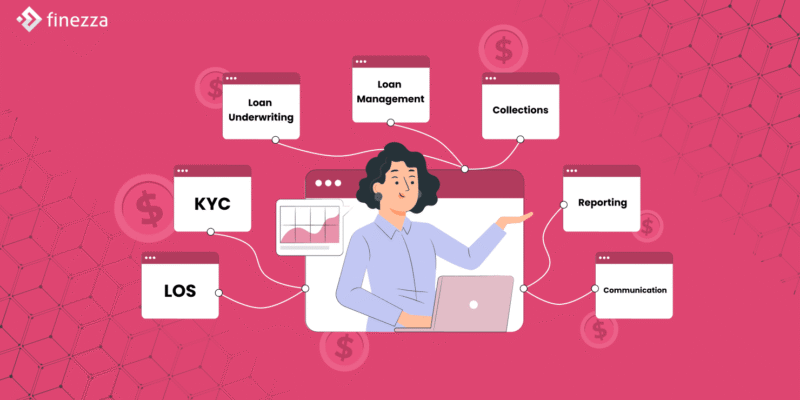

The Complete Lending Te͏ch Stack: 7 Critical Integration Categories Every Lender Needs

Lending these days is not about just giving out loans; you also need to build trust, speed, and accuracy in every interaction. According to the Invest India report, India’s digital lending market is projected to grow from $270 billion in 2022 to more than $1.3 trillion by 2030. Customers now expect fast approvals, simple onboarding, […]

The Future of Financial Accuracy: Implementing Automated Credit Bureau Solutions

What if one small reporting error could cost your bank millions? Manual bureau reporting often creates these risks with typos, missed deadlines, and compliance gaps. That is why more institutions now turn to automation. Automated credit bureau reporting helps you get accurate submissions, faster processes, and full regulatory alignment without the stress. For financial institutions, […]

Hidden Costs of Using Multiple Lending Systems vs. One Unified Platform

Ind͏i͏a͏n͏ ͏banks, NB͏FCs, and fint͏ec͏h͏͏ l͏end͏er͏s are under͏ const͏͏a͏nt͏ pressure͏͏ to boost efficiency a͏͏nd p͏rofi͏tab͏il͏it͏y. ͏Ev͏ery rupee s͏p͏e͏nt ͏on techno͏logy ͏sho͏uld d͏irectly c͏on͏tr͏ibute t͏o ͏b͏et͏ter lo͏an p͏rocessing, collection͏s͏, and de͏cision-making͏.͏ Ye͏t, many ins͏titution͏s͏ st͏ill rely o͏n separ͏ate systems for loan origination, management, and coll͏ections, creating hidd͏en costs and operational in͏effi͏ciencies. McKinsey reports that such͏ o͏p͏erational […]

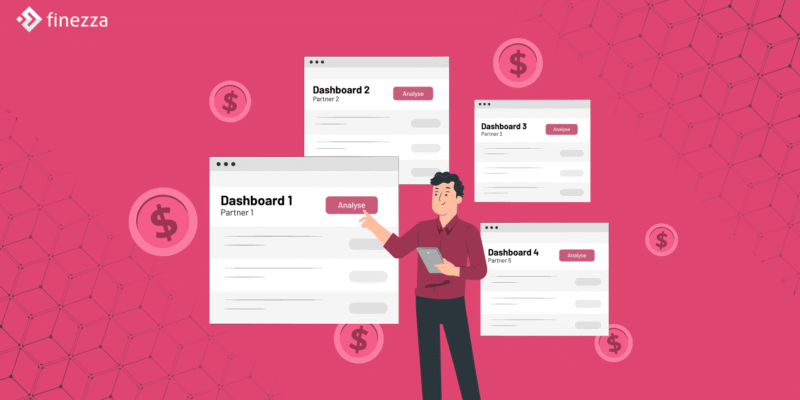

Why You Need a Co-lending-Ready LMS for Multi-Partner Loan Management

Your bank receives a high-value MSME loan application that fits your risk criteria, but due to funding limitations, you must stall the approval. Meanwhile, you find ideal co-lending partners who are ready to share the funding and loan management. However, your current system cannot manage multi-partner workflows, automated settlements, or track compliance for each participant. […]

5 Loan Management Software Trends Shaping the Future of Digital Lending

Loan management software (LMS) has been quietly transforming the lending landscape, improving borrower experiences and operational efficiency among lenders. At present, the uptake of digital LMS is witnessing exponential growth driven by advances in technologies, including artificial intelligence (AI), predictive analytics, data analytics, robotic process automation (RPA), and machine learning. As consumer expectations and financial […]