NBFCs across India are preparing for a landscape where speed will decide survival, and delays will drive customers away. The recent industry studies predict that in 2026 over 82% of borrowers will choose lenders who offer fast approvals, while nearly 65% of NBFCs confirm that their biggest struggle is reducing Loan TAT. With rising application […]

Creditworthiness vs Credit Score: What Smart Lenders Actually Look At

A credit score alone cannot determine lending risk. While they provide a snapshot of past borrowing behaviour, they miss critical signals about a borrower’s current financial capacity and future repayment potential. Understanding the distinction between creditworthiness vs credit score is essential for sound lending decisions. A credit score reflects historical borrowing patterns, but it doesn’t […]

Top Loan Management Software for NBFCs in India 2026

India’s lending market is expected to reach $2.38 billion by 2030, growing at 30.2% annually. Economic expansion, urbanisation, and rising credit demand are driving loan application volumes that exceed most NBFCs’ manual processing capacity. Legacy systems struggle with regulatory reporting frequency, multi-product portfolio management, and real-time risk assessment requirements. NBFCs processing diverse loan products (MSME, […]

Are You Reading Credit Bureau Reports Wrong? 5 Critical Data Points Lenders Miss

You approved a borrower with a 750 credit score, perfect payment history, and 35% utilisation. Three months later, they defaulted. If your lending institution is facing similar incidents more often, you are probably missing evaluating the critical data points in credit bureau reports. According to RIS (Research and Information System for Developing Countries), unsecured loans […]

How Pre-Integrated Lending Platform Accelerate Time-to-Market

Pre‑integrated lending platform solutions are rewriting the rules of digital lending. Lenders historically built bespoke systems with long implementation cycles, manual processes and rising costs. In a market where borrowers expect instant credit decisions, these delays are costly. Statistics show that India’s digital lending market could reach ₹15 trillion by 2030 with a 25.6 % […]

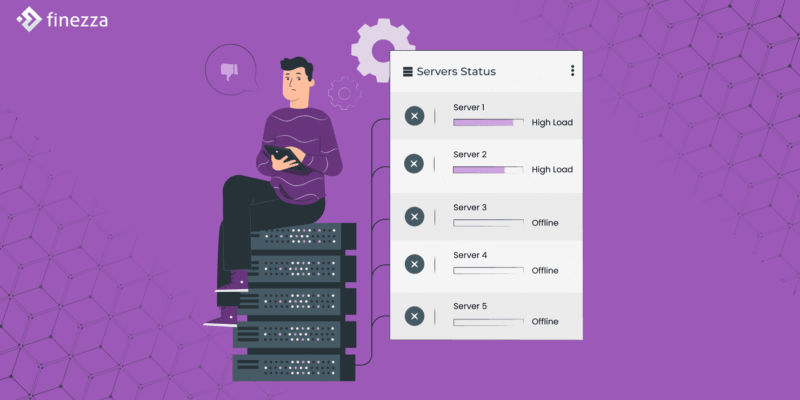

Integration Debt: The Silent Killer of Lending Technology Roadmaps

Rapid innovation is reshaping the financial landscape; however, the success of lending technology roadmaps hinges on seamless integration with existing systems. Integration challenges can undermine even the most advanced solutions. This is particularly evident in the Indian context, where technology investment patterns reveal unique challenges and opportunities. A report in Business Standard highlighted that many […]