Every time a bank processes a new loan application, it brings both growth and risk. As digital banking expands, loan fraud is growing just as fast. According to a 2024 TransUnion report, online fraud attempts within financial services increased 17.2% worldwide over the last year. This sharp increase highlights a critical gap – conventional fraud-detection […]

How One LMS Can Handle Multiple Loan Products (Instead of Managing 5+ Separate Systems)

In India’s credit-driven economy, lending speed directly impacts revenue efficiency. However, lending operations teams typically juggle 5+ separate systems daily, whilst IT departments manage isolated databases for each loan type. This creates significant operational inefficiencies. The solution? One unified loan management system. A single, cloud-based LMS can manage everything, from approving vehicle loans to complex […]

How Modern Loan Origination Software Can Cut Your Approval Time by 60%

Loan origination has evolved from a paper-heavy, weeks-long process to a digital-first experience where borrowers expect instant decisions and transparent communication. As borrowers become accustomed to real-time digital services, expectations around speed and transparency are reforming lending standards. The global digital lending platform market was valued at USD 10.55 billion in 2024 and is projected […]

How Loan Origination Systems Streamline the Four Stages of Lending

We cannot discuss digital-first loan origination systems without commenting on India’s commercial loan portfolio, which expanded by an impressive 17.8%, reaching ₹64.1 trillion in the financial year (FY) 24. Additionally, while Medium and Small Enterprises (MSME) loans witnessed a 13.9% year-on-year (Y-o-Y) growth between FY 2020 and 2023, individual loans grew by 13.5% Y-o-Y in […]

Alternative Credit Scoring in India: Expanding Financial Inclusion

Financial inclusion has emerged as a significant opportunity for lenders in India. As of December 2024, World Bank data estimated that India’s credit-eligible population, comprising consumers aged 18 to 80, stood at approximately 1,036 million. However, only 27%, or approximately 277 million consumers, utilised formal credit facilities. Approximately 451 million Indians have limited or no […]

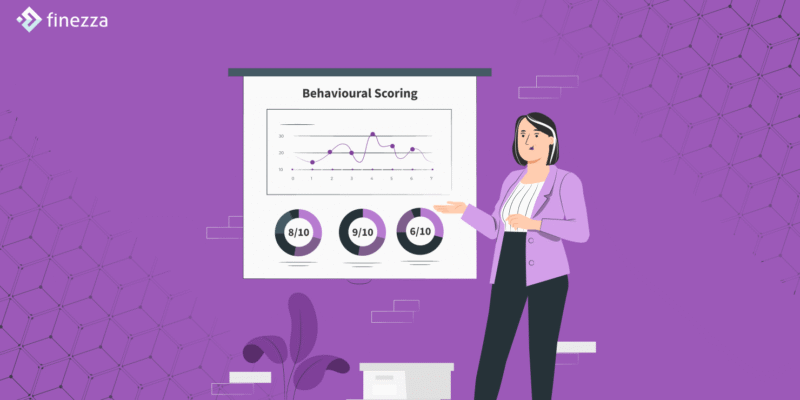

Behavioral Scoring: The Smart Approach to Line of Credit Risk Management

In 2022, around 160 million people in India were credit-underserved. One reason for this is the overreliance on traditional scoring models, which typically consider parameters such as payment history, debt-to-income ratio, and length of credit. However, traditional credit scoring models do not account for an individual’s lack of credit history or other important parameters, including […]