Non-Banking Financial Companies (NBFCs) are making a behind-the-scene yet significant impact on the Indian economy. Despite not having a traditional banking license, they promote financial inclusion, support economic development, enhance innovation, and deepen financial markets. A report by the Reserve Bank of India (RBI) reveals that the share of NBFCs in the total credit extended […]

Streamlining Loan Approvals with Automated Credit Underwriting Software

Recently, the RBI’s June Financial Stability Report revealed that retail loans in the Indian banking sector experienced an impressive compounded annual growth rate (CAGR) of 24.8% between March 2021 and 2023. A pivotal reason for this growth is the ongoing transformation of the traditional and time-consuming manual loan approval process, driven by the adoption of automated […]

How Commercial Loan Management Software Powers Digital Transformation

The demand for rapid access to credit in business is continually growing. Businesses across all segments, but especially in the Micro, Small & Medium Enterprise (MSME) segment, seek access to funds to accelerate business growth. Experts predict that business loans to MSME borrowers will rise by 20% in the festive season, especially as consumer spending […]

Unlocking Financial Inclusion with Microloan Management Software

Historically, poor credit penetration results in the marginalised sections of society like low-income households, women and Micro, Small, and Medium Enterprises (MSMEs) being excluded from the formal lending channels. However, the MSME sector plays a critical role in the economic development of India. The share of MSME Gross Value Added (GVA) in India’s Gross Domestic […]

Why Coding Matters in Loan Management System Development

Coding is an integral part of many everyday transactions and interactions for most people. It powers activities ranging from making payments on E-commerce sites, booking a cab, or using Bluetooth in the car. As per an IBM Institute for Business Value report, 92% of executives agreed that their organisation’s workflows would be digitised and use […]

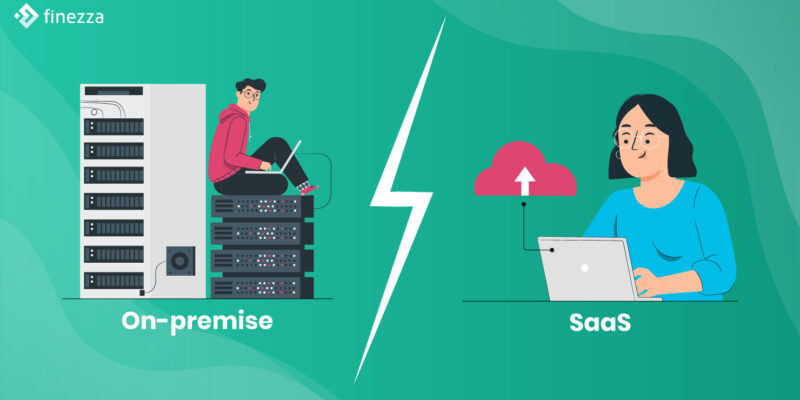

Decoding the Right Loan Recovery Software: On-premise vs SaaS

Salesforce changed the course of the enterprise-grade loan recovery software industry when the company rolled out a software-as-a-solution (SaaS) CRM in 1999. Over the next few decades, cloud-based SaaS solutions garnered immense popularity, replacing on-premise solutions across various sectors. A Gartner study projected that global SaaS spending will likely reach $195 million by the end […]