Uninterrupted cash flow is the lifeline for all businesses; however, it is not uncommon for companies to have considerable gaps between a sale and receiving payment, which can disrupt their liquidity.

As a result, ensuring smooth cash flow can be quite challenging for businesses, especially the ones that allow long credit periods to their customers. Also, these piled-up receivables can result in a severe cash crunch and snowball into other business-threatening issues.

As per Entrepreneur report, more than 80% of businesses fail due to lack of cash; 20% of small businesses fail within the first year, while half fail within 5 years.

In this situation, debt factoring and accounts receivable financing are two options that can help businesses balance their liquidity and credit sales for smooth day-to-day operations.

While both are excellent short-term finance options, they differ in a few aspects. In this blog post, this is going to be our key topic.

What is Debt Factoring: An Outline

Debt factoring, also known as invoice factoring, is a finance instrument that converts outstanding invoices to immediate cash. This option allows a business to sell its accounts receivables to a “factor” (third party) at a discount. The factor pays a pre-determined percentage of receivables upfront and takes up the responsibility of collecting the dues from the customer on the due date.

The factoring company usually pay 75%- 90% of the invoice in advance and the remainder after collecting the dues from the customer. After collecting the payment from the customer, they pay the business the remaining amount after deducting their fees.

Debt factoring helps businesses stabilise their cash flows without compromising on customer relations. The firm need not hesitate when extending credit to their customers or wait for customers to pay, and they need not hesitate when extending credit to them. With invoice factoring, they can unlock the funds tied up in the unpaid invoices and use them for their day-to-day functioning.

What Is Account Receivable Financing?

Accounts receivable (AR) financing is also a short-term finance option that uses outstanding invoices to fund growth. Like debt factoring, AR financing provides the business with an alternative to the traditional line of credit to manage its cash flow requirements.

AR financing is asset-based lending; the invoices act as collateral against which the lender, usually a bank, lends funds to the business. The firm retains the ownership of its accounts receivables.

Generally, lenders lend up to 75% to 85% of the AR value to the business. Lenders charge interest on the loaned amount until the business repays the entire amount.

This is to note that companies generally do not use all their accounts receivables for financing; businesses decide which customer’s invoice they want financed, but they do not choose which specific invoices.

What is the Difference Between Debt Factoring and Account Receivables Financing?

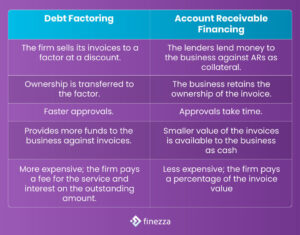

Debt factoring and account receivable financing unlock the funds tied up in invoices, which impact the working capital availability of a business. However, these two finance options differ in the following five aspects:

-

Ownership

A fundamental difference between debt factoring and account receivable financing is ownership of the invoices. In the former option, the ownership is transferred to the factor, and the customer pays the dues directly to them. In AR financing, the business retains the ownership of the invoices and is responsible for collecting the dues.

-

Costs associated with financing

When a firm chooses the AR financing option, it pays a fee for the service, usually a percentage of the invoice value. The factoring option requires the business to pay interest on the outstanding amount and a fee for the service.

-

Invoice value

No minimum invoice value is fixed for the AR financing option; a business can get even small invoices financed. Regarding factoring, lenders are willing to finance invoices above a minimum amount. This means a firm can get only larger invoices financed.

Lenders can manage and track their loans more efficiently with solutions like Finezza’s Loan Management System and service their customers better.

-

Eligibility requirements

Eligibility requirements for both options also differ. Lenders are willing to finance ARs if the business has a good credit profile and a strong financial position. For the factoring option, the customer should have a good credit history and be in a position to pay their invoices on time.

-

Time taken

Factoring is a quicker financing option; it usually takes 24 hours to obtain the funds. Invoice financing has a longer turnaround time, and a business might have to wait for days or weeks to get the funds.

The table below gives a snapshot of the differences between the two.

Debt Factoring or Account Receivable Financing: Which Is Better?

As the discussion reveals, both debt factoring and account receivables financing help a business manage its cash flow requirements. So, how does a firm choose the right option for them?

Below are four aspects firms should consider when making a choice.

-

How fast do they need the funds?

Both options are faster when compared to traditional business loans. However, debt factoring allows quicker access to funds, so if a business needs funds quicker, then factoring is the right choice. If they can wait for a while, then account receivable financing could be an option for the business.

-

How much funds do they need?

Debt factoring offers a higher percentage of the invoice’s value to the business than AR financing; thus, it provides a firm with more funds vis-a-vis invoice financing.

-

How much are they willing to pay in charges and interest?

Account receivables financing is comparatively less expensive as compared to invoice factoring.

-

What is the credit score?

Account receivable financing norms are stricter; hence, lenders are willing to approve financing only for customers with good credit profiles.

Debt factoring offers more funds to a business, faster access and may be suitable for firms with a high volume of invoicing, though it may cost more compared to AR financing.

Conclusion

For a business considering debt factoring or account receivable financing as options for cashflow management, it is advisable to compare both options and also get quotes from different lenders to compare costs and other terms.

However, one size never fits all; thus, each business needs to look at its requirements before it makes a choice. There may be situations when invoice factoring may be more suitable for a business, and on other occasions, invoice financing may work better for the same firm.

Web-based Lending Lifecycle Management Platform Finezza offers solutions that leverage emerging technology like artificial intelligence and machine learning for efficient lending portfolio management.

Book a demo to know more.

Leave a Reply