The introduction of the ‘Account Aggregators’ is said to usher in a new era of India’s financial landscape. However, many analysts view it as a masterstroke strategy by RBI to empower and strengthen the data transfer needs of various stakeholders involved.

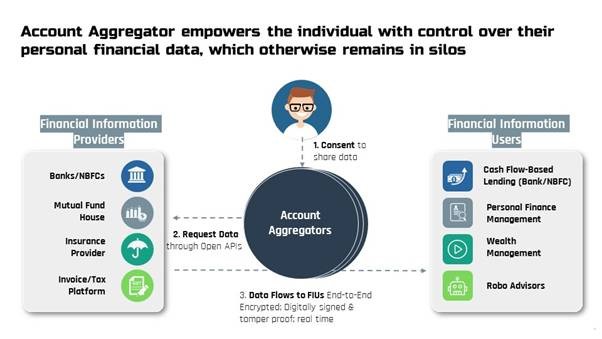

Designed to help millions of customers get digital access to their data and help various fintech companies expand their customer pool, the Account Aggregator approach aims to streamline the diversity of data points into a unified system that will be available for analysis.

What are account aggregators? How do they work? What are the different use cases of AA, and how does the Indian account aggregator ecosystem look like at present? Let’s look at everything in detail.

Account Aggregators in India

As soon as the AA framework was introduced in India on September 2nd, 2021, eight major Indian banks quickly jumped onto the AA bandwagon. These banks are Axis Bank, Kotak Mahindra Bank, ICICI Bank, State Bank of India, IDFC First Bank, HDFC Bank, Federal Bank and IndusInd Bank.

Four other NBFCs that have received approvals by RBI to operate as AAs include CAMS Finserv, Finvu, OneMoney, and NESL.

Customers can choose to get themselves registered on any AAs by downloading their mobile app and following the steps. Customers can also choose between AAs.

Image courtesy of the Ministry of Finance. No Copyright Intended

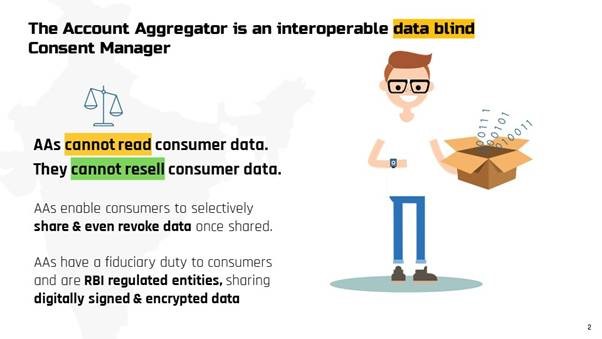

An important thing to note here is that customer data is shared with the FIUs across the AA network only after explicit consent from the customer, thus ensuring ethical and secure data practices are followed.

The simple idea behind AAs is to capture those outside the scope of formal credit by capturing their digital footprints in every possible manner and providing them access to a more traditional way of acquiring finance.

Similarly, it paves the way for different lending agencies to assess their creditworthiness better and de-risk their loan books by predicting NPAs.

Use Cases of Account Aggregators

Following are some of the current use cases of Account Aggregators in India, which will transform the way people view these different means of dealing with everyday finances.

Lending

A loan applicant has to undergo cumbersome manual processes of acquiring essential documents, getting them notarised and furnishing them in a unified format to a bank or NBFC to get a loan. In addition, there are a lot of touchpoints involved due to which this data runs the risk of being incomplete, tampered with or even forged altogether.

AAs make it easy for customers and lending agencies to get hold of this data via a single click on the AA framework. The AA will fetch such documents directly from different agencies and furnish the same to the lender, once a customer consents.

What’s more encouraging is that AAs are looked upon as credit gap fillers between MSMEs and lending agencies, which has a huge potential for growth as only 8% of Indian MSMEs have access to formal credit today.

Wealth Management

Wealth management is an underdeveloped yet upcoming sector in India. According to a Boston Consulting Group (BCG), the total financial wealth of Indians will grow at 10% p.a. to $5 trillion by 2025! This mass fortune will require proper avenues of formal investment, which implies a growing opportunity for wealth managers.

However, wealth managers across India have adhered to the traditional sourcing of critical financial documents from clients in the physical format. This method is not only time-consuming but also comes with its own set of problems.

Image courtesy of the Ministry of Finance. No Copyright Intended

AA can completely revolutionise the wealth management market, wherein a client can simply give a recurring consent to their AA for providing access to their financial details to their wealth managers and save a lot of to-and-fros.

Personal Finance Management

Financial literacy is on the rise globally, thanks to different personal finance management platforms that have come up. As a result, the size of the global personal finance management market is estimated to reach $1,213 million by 2023!

However, a recent survey by Scripbox, which is an Indian online mutual funds platform revealed that 56% of the respondents lacked the knowledge to handle personal finances better. Much of this can be attributed to a lack of initiative on a personal level and the inefficiencies existing in how these personal finance management platforms work.

For example, different PFM apps require the client to upload their pdf documents onto the app or portal or even share their login credentials with the app. This practice is full of problems such as data privacy issues or issues of cyber theft.

Having an account aggregator embedded into the system will soar the general public’s confidence to initiate personal finance decisions.

Some FAQs Pertaining AAs

Since Account Aggregators are new in India, customers are bound to have questions regarding the same. Here we address some of the important FAQs:

- Do I need to pay for Account Aggregators?

- Most Account Aggregators are completely free since they will charge the financial institution. But some may charge a small fee.

- Do I need to register with different AAs separately to use them?

- No, users need not separately register with different AAs they would use.

- Once my data is shared with AAs, how long will they be accessible to financial institutions?

- Customers will be let know of the data sharing tenure while signing for the consent.

- What sets Account Aggregator apart from Aadhaar eKYC data sharing, credit bureau data sharing, and CKYC platforms?

- For KYC purposes, Aadhaar eKYC and CKYC only allow sharing four ‘identity’ data fields (eg name, address, gender, etc). On the other hand, credit bureau data only shows loan history and/or a credit score. Transaction data or bank statements from savings/deposit/current accounts can be shared over the Account Aggregator network.

- Can the AAs collate my data? Is it secure?

- AAs cannot view the data as such; they simply move it from one financial institution to another with an individual’s permission. They cannot ‘aggregate’ your info. AAs aren’t like internet corporations that aggregate personal data and profile you. The sender encrypts the data, and only the recipient decrypts it. Sharing documents over email is far less safe than using end-to-end encryption and technology like ‘digital signatures’.

The Bottom Line

The data floating on the AA framework is encrypted to prevent any instances of leakages or exploitation, making it one of the most cutting-edge digital solutions to the financial ecosystem of India. It is an excellent step towards achieving true data empowerment in actual terms.

Finezza is a suite of end-to-end lending solutions to streamline financial analysis and decision assistance for any new-age, growth-oriented lending firm. We offer state-of-art lending lifecycle management and credit evaluation services to lenders and other financial institutions. Finezza also has a framework for GST A and ITR E verification. In addition, it makes it simple to check a consumer’s GSTIN and ITR data for accuracy. For more information on how you can benefit, contact us today.

Leave a Reply