It is common for companies to offer credit terms to their customers to increase sales and build customer relations. As a result, the company cannot access their money until the customers pay all the invoices. This leads to cash flow problems for the company, making it difficult to manage day-to-day operations and invest in the future expansion of the enterprise.

Invoice Financing and Factoring can help businesses access external sources other than traditional lines of credit, like banks, to maintain their supply lines, logistics, warehousing, and employees from time to time.

Typically, banks can finance businesses by giving out credit, but this requires collateral, considerable documentation, and unforeseen delays that take away crucial time from the business.

In this article, understand how to leverage unpaid invoices from businesses through Invoice Financing and Factoring to get the best return from your lending operations without risking too much in this digital environment.

What is Invoice Financing for a lender?

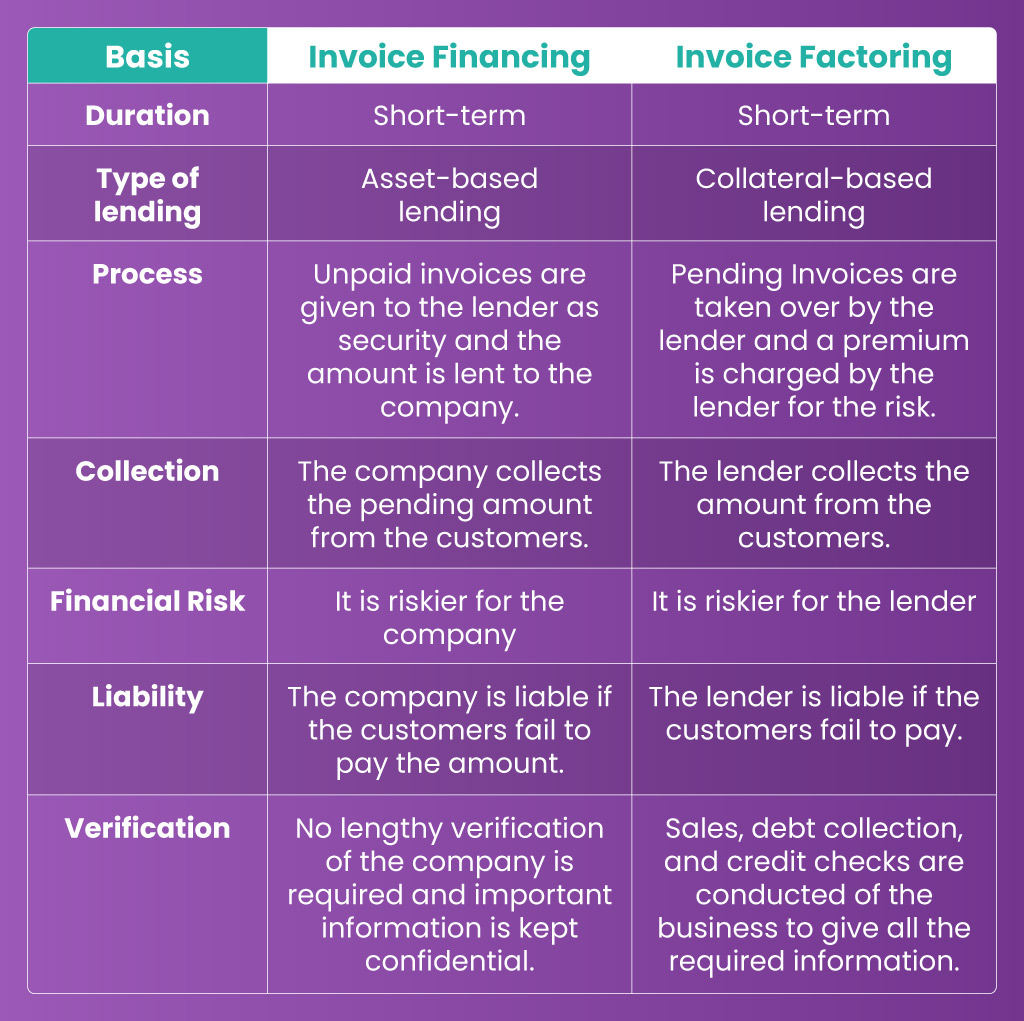

Invoice Financing is a short-term loan provided to businesses by keeping unpaid invoices as collateral. Once the customers pay, the lender can pay back the remaining amount after deducting the agreed-upon fees during the agreement.

The Invoice Financing process helps businesses shorten the time to convert inventory investments into cash and fund their working capital needs, including paying employees, suppliers, and other vendors.

Invoice Financing includes both factoring and discounting. The difference between Invoice Factoring and Invoice Discounting is the payment collection mechanism from the customer.

In Invoice Financing, the burden of collecting customer payments is on the business. In contrast, in Invoice Factoring, the lender collects the customer’s payment and charges a premium from the business for their services.

There are many benefits to Invoice Financing (discounting):

- Business-to-business transactions and reliable customers reduce default risks.

- The company needs to provide fewer documents.

- Quicker recovery time from customers.

Invoice Financing (discounting) in action:

For instance, small business A, which has various customers with outstanding invoices, requires short-term capital for its business needs.

In such a case, it approaches lender B with its invoices of $1000. B lends 80% of the amount, i.e. $800, and keeps the invoices as collateral. When the customers pay back the amount to B, the lender can pay the remaining amount to A minus an agreed-upon fee.

This way, the pending and unpaid invoices in business A can provide an alternative for a short-term loan, and the lender can access a risk-free lending option, provided the paperwork of contracts and invoices is solid.

What is Invoice Factoring for a lender?

Invoice Factoring is a form of borrowing through which businesses sell unpaid invoices to a lender in exchange for a percentage of their value.

The lender pays a percentage of the invoice amount upfront according to the advance rate of the industry. An advance rate is the perceived risk taken by the lender and it varies from industry to industry.

The lender takes over the risk of the invoices to collect the payment from the customers, for which the lender charges a premium from the company.

Benefits of Invoice Factoring:

- It is prevalent in B2B transactions because of lengthy supply lines where credit is preferred over cash, so the risk is lower.

- The lender can charge a premium for seeking payments on company’s behalf.

Invoice Factoring in action:

Company A is in a seasonal business and requires immediate cash for its operations. It approaches Lender B with its invoices of $1000 and receives $600-900 (60-90%) as an advance.

The lender takes over the invoices and approaches the customers for payment. Lender B pays back company A minus factoring fees.

The factoring fee is the premium charge by the lender for taking the risk on behalf of A, and it is more than the amount of Invoice Financing. Company A gets access to cash immediately to finance its operations with the pending invoices.

Invoice Financing v/s Invoice Factoring

The opportunities offered by Invoice Financing and Factoring

Invoice Financing and Factoring provide an excellent opportunity for the lender to profit by taking a relatively minor risk and seeking the correct details from the business like:

- The amount of Invoice Financing required by the business

- Financial turnover of the business

- The customer base of the business

- Total outstanding invoices of the business and the invoices furnished

- Bank statement of the business

- Credit analysis of the business

- Document identification and verification

- Collection Delinquency risk

- Taxation formalities

The lender can make an informed decision about the business invoices by getting the correct information and furnishing loans accordingly.

How Finezza can aid your lending journey

Invoice Financing and Factoring allow businesses to borrow money against the sums owed to them by customers. It can boost the cash flow and help reinvest in operations and business expansion.

In Invoice Financing, the company collects the payment from the customer and pays back the lender.

In Invoice Factoring the lender takes over the risk of tracking down the customers.

Therefore, the lender must make an informed decision about the credentials of the business and its customers.

Finezza has developed a product suite of software that helps the lender in:

- Tracking and managing credit applications

- Process KYC documents faster

- Assess lending risk and loan origination

- Perform credit analysis

- Loan Management

Contact us today to streamline your entire process of lending and lend to more businesses!

Leave a Reply