Banks of all sectors have been slow to innovate and adapt to technological changes. This has been primarily due to their extensive infrastructure that can make the adoption of new tech a logistical nightmare.

Also, due to lack of competition and their monopoly, banks are in no hurry to innovate. However, the financial sector is undergoing a digital transformation. Embedded finance is one way many fintech and non-finance firms are modernising themselves and giving customers a better customer experience (CX).

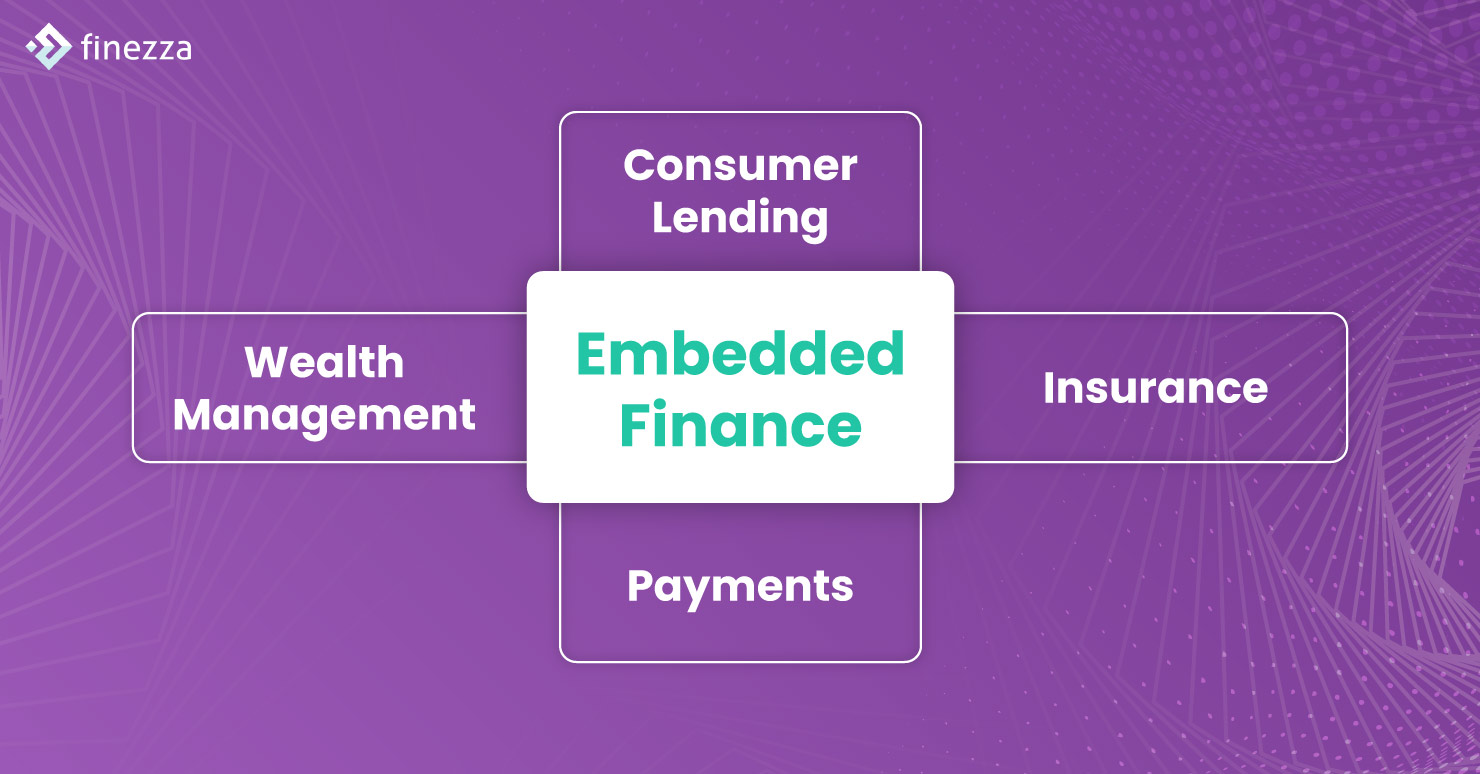

What is Embedded Finance?

The lending institutions are developing digital-first solutions and leveraging embedded finance to provide an enhanced customer experience.

Embedded finance allows customers to avail financial services on their terms at any time and from anywhere. The customer no longer needs to visit the bank branch to access the money. In addition, it allows for seamless integration of a financial service into a non-financial website or an app.

For instance, integration of payments services across a range of non-banking platforms like mobility (Grab, Uber), social networking (Whatsapp, WeChat), e-commerce (again Amazon and Alibaba) are examples.

In the wake of COVID-19, India’s FinTech investments increased by 60% to $1467 million in H1 2020, compared to $919 million the previous year.

Ultimate Customer Experience With Embedded Finance

As traditional banks, fintech companies, and lending institutions embrace embedded solutions, it is likely to be the future of banking. And when it comes to customer satisfaction, positive experiences influence purchasing decisions in banking and finance for 75% of people.

You won’t have many chances to get it right when it comes to the customer’s experience. As per a PwC report (PDF), 1 in 3 consumers (32%) say they will walk away from a brand they love after just one bad experience. In Latin America, this figure is higher at 49%.

Embedded finance offers innumerable benefits to those who use these financial products. One of the most significant benefits is the delivery of a seamless customer experience.

Consumers place a high value on speed, convenience, helpful workers, and nice service, with each receiving over 70% of the vote.

Embedded solutions enable futuristic banking services and shape customer experience in the context of COVID-19: clarity, transparency, speed, support for digital tools.

Here’re ten ways how embedded finance can redefine Covid-era customer experience:

1. Customer-centric Business Interactions

As more people are going digital in response to the social distancing brought on by pandemics, lending institutions would want to capitalise on the shift by offering relevant digital financial products and services. Companies can do this by joining customer’s buying journey and focusing on what they want (buy products) rather than what the financial institutions wish to (sell loans). Offering financial solutions at convenience is one way to cater to their desires.

2. Embracing Banking Disruptions

It would have been weird to ask people to avail financial services from a non-traditional institution like an e-commerce company, earlier. But these days, it is expected that embedded finance has streamlined and changed how banking is carried out. Take, for instance, Amazon. The eCommerce giant offers instant lending to eligible buyers via Amazon Pay services in partnership with ICICI Bank.

3. Through, Safe and Secure Data Sharing

Embedded finance has brought a change in the mindset of the customers. Although they are wary of data breaches and have security concerns, they are willing to share personal information, including financial details, with third parties. Businesses can offer financial services at the right touchpoint backed by high-profile encryptions, allowing a seamless customer experience.

4. Increasing Financial Product Visibility

Traditional banking involves a visit to the bank branch. Once a customer reaches there, they may learn about other products such as loans. However, (fintech) companies can use embedded finance technology and leverage personal information such as credit history to recommend appropriate products, thereby increasing chances of fulfilling customer needs and closing a deal.

5. Bridging CX Gaps

Fintech companies can use the data algorithms to analyse consumer behaviour and identify patterns to find new opportunities in product offering, support and experience. Embedded finance enables companies to develop products that will help their clients in their transaction journey.

For example, users often abandon carts when shopping online because their credit or debit cards may be unreachable at that moment. If the payment details were readily available through the embedded finance apps or options like Buy Now Pay Later (BNPL), they would be more likely to complete such transactions.

6. Being Advantageous to Businesses

Embedded finance streamlines transactions, keeps customers engaged, and increases revenue streams for the business. When a business has a user-friendly interface, it will improve customer experience, and they would return with smoother transactions and increasing conversion rates. In addition, embedded solutions can help gather customer data, understand their needs and help to serve them better.

7. Adapting to Changing Consumer Habits

While the older generation prefers traditional purchasing methods, the new tech-savvy generation relies on shopping through social media and online platforms. However, more people who went to brick and mortar stores are shifting online. The pandemic has made the shift a necessity. In this light, digitisation and embedded finance are providing last-mile connectivity.

8. Tech Matters

Scalability and connectivity are crucial to every business. New age transactions have buying and lending taking place simultaneously. Embedded finance creates an easily configured cloud-based platform that can provide efficient service as per customer needs. It entails open APIs and trusted tech partners for safe and secure integration of third-party providers across channels.

9. Leveraging Established Relationships

When applying for a loan, most people trust their bank to share their personal information. Financial institutions can leverage embedded finance to use this established trust and build upon it. They can continue providing best-in-class services to fields they were already excelling at, like regulatory compliance, helping customers in their financial journey. At the same time, embedded finance will add another feather to the hat with exceptional lending or other services.

10. Satisfying Existing Customers

It is often irritating for most customers when they are redirected to other applications for completing a task or purchasing. Customers maintain loyalty if they have a unified, easy-to-use platform for purchasing. A single platform that is easy to navigate, obtain services and complete transactions faster assists in the customer journey. Embedded solutions provide newer avenues to serve existing customers and acquire new ones.

Here to Stay

All this said it is clear that the embedded finance is here and likely to stay. It is the future, even though there are challenges and concerns regarding the same. Though traditional banks are slow to adopt it, financial institutions may leverage embedded solutions to reduce friction and enhance customer experience.

Finezza, with its digitised consumer-centric embedded finance solutions, can help your business excel in creating a next-level customer experience. Contact us today to know more.

Leave a Reply