Loan syndication by banks has always existed for large business loans. The real challenge is in the small and medium-sized enterprises (SMEs) market, which represents a significant share of the digital lending landscape in India. A conservative estimate puts this market at a whopping $300-$400 billion by 2025!

The Indian finance industry has long used the co-lending model of credit. The CLM has gained much more significance and has become a viable solution to liquidity and credit access issues due to the recent expansion of fintech resources and abilities.

After discussions with some of India’s leading NBFCs and fintechs, we at Finezza have built a co-lending compatible LMS (Loan Management System) that can streamline the lending process for all parties involved.

This new functionality has been precipitated by the keen interest and agreement of several large fintech non-banking financial companies (NBFCs) who have approached us based on our domain understanding.

What Makes Finezza’s LMS Highly Compatible With Co-Lending?

Our co-lending compatible LMS is designed to handle the operational intricacies of co-lending effectively so that customers are not troubled in any way.

Co-lending involves the proportionate sharing of risks and rewards of loans between banks and NBFCs. This can present challenges in underwriting, loan processing, sharing of interest, charges collected, apportioning costs, and risks of loan defaults. When NBFCs have multiple co-lending partners, the process becomes even more complex.

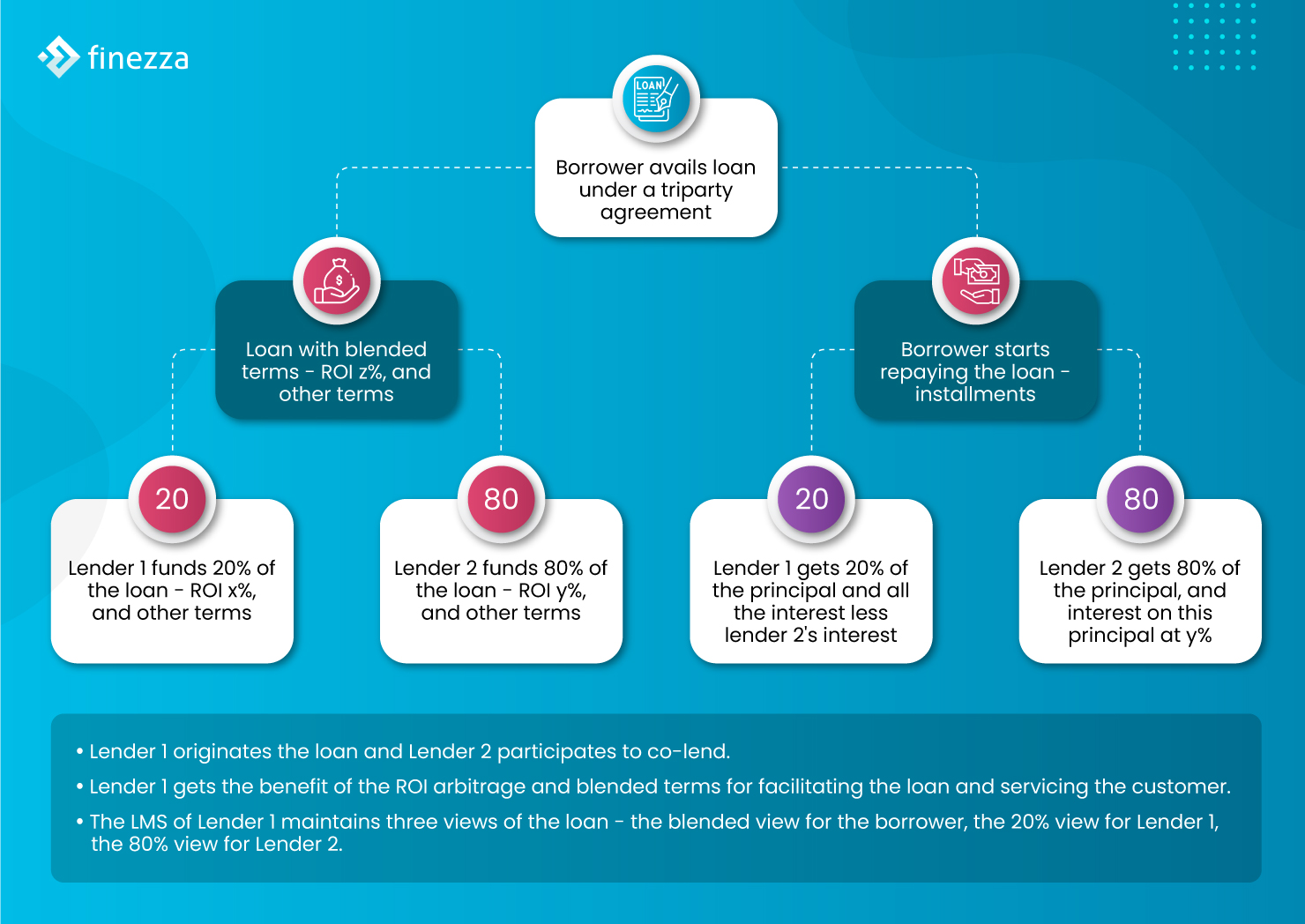

An NBFC or a lender facilitates the loan and is the only point of contact for the customer. The RBI requires the NBFC to contribute at least 20% of the loan amount; the remainder can be from one or more co-lending partners. These partners can have different agreements with the facilitating lender regarding the distribution of interest, charges, penalties, and defaults.

Finezza’s LMS can handle all the complexities of different agreements so that customers can see their loans as a single entity. Let’s get into the core features of this platform.

Features of Finezza’s LMS That Will Raise The Efficiency Of Co-Lending

Finezza’s Loan Management System is designed to cater to the unique needs of the co-lending model as it simplifies complex co-lending procedures and offers numerous competitive advantages.

1. Streamline the Splitting of Risks and Rewards

When it comes to co-lending, businesses can face multiple challenges. Even though the bank and NBFC might lend at an agreed ratio, the bank and NBFC will often have different costs of funds.

So the most significant inefficiency the platform will handle is processing fees, delayed interest, and penal interest between banks and NBFCs. Splitting the money based on these different terms won’t be an operational nightmare when EMIs start coming in.

2. Personalised and Multi-View

The bank needs a clear view of its 80% stake in the loan, and the co-lending platform will provide this by creating three views of the loan – 100% for the customer, 20% for the NBFC, and 80% for the bank. This way, the parties involved will clearly understand their investment.

3. Automated KFS Sharing

RBI’s guidelines state that the lender should share a Key Facts Statement (KFS) with the borrower. Finezza’s co-lending compatible LMS will automate this process.

4. Automated Reporting

The NBFC and bank must report their loan share to the credit bureau. The platform can also automate this operational hassle.

5. Automated Bookkeeping

The platform will also automate bookkeeping for this complex setup by generating the ledger and trial balances in line with the share of the participants on loan. The NBFC will know how much to return to the bank, and the latter will know how much to take from the NBFC.

Wrapping Up

The co-lending concept allows all stakeholders to be more adaptable, take bigger risks, and generate more revenue. It also enables the customer to obtain a loan from the formal credit market at a low-interest rate.

Co-lending also presents a fantastic business opportunity for banks and NBFCs in India. By partnering, they can fund many credit-underserved customers. The success of this business model depends on the technical competence of the co-lending LMS.

Finezza’s Co-lending Loan Management System removes operational inefficiencies and helps scale your lending operations. Our system makes it easier to process loans under the co-lending model and eliminates many of the inefficiencies that come with it.

Contact Finezza to book a free demo if you are a financial institution wanting to improve your Loan Management System.

Leave a Reply