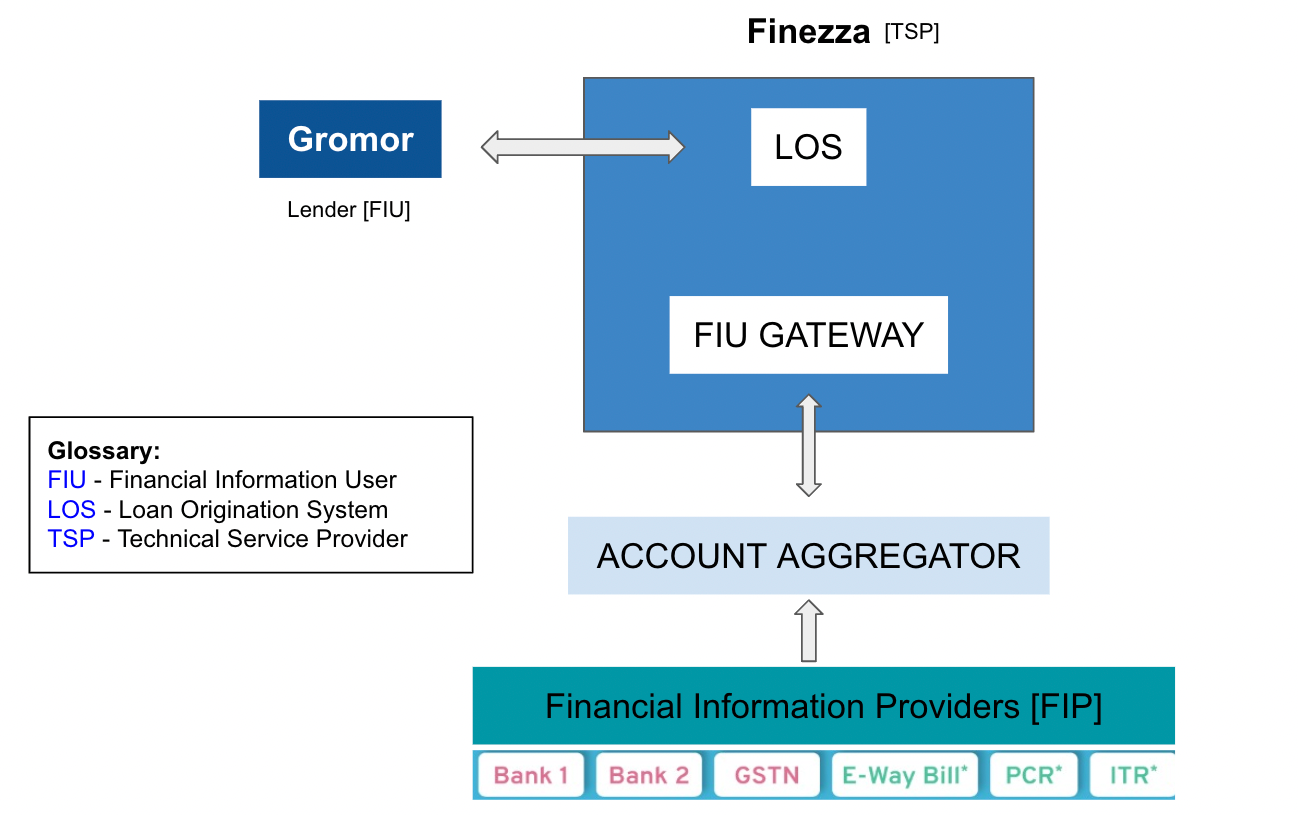

Account aggregators are RBI-regulated entities that collect financial data from Financial Information Providers (FIP) like banks and tax departments and give access to Financial Information Users (FIU) like investment firms with customer consent.

As many as 61% of the bank executives believe that a customer-centric model is “very important” in today’s digital age, as per a financial services report by PwC.

AAs collect the combined data and transaction data or bank transactions history, which makes it comprehensive. In addition, users are empowered as registering with an AA is voluntary.

If the user’s bank is part of the AA network, they can choose the accounts they want to share for the time period they want to by giving ‘consent’. The users also have the right to revoke the consent later.

The architecture of AA is designed not to see, sell, or store information but only to collect and relay it.

It is a financial dashboard of the user where data is saved while securely encrypted, and it remains protected and private.

Loan Origination System (LOS) – Account Aggregator Use Case

Credit evaluation and loan monitoring has been a principal task for any lending institution. For evaluation, legacy methods entailed sourcing bank account data from their borrowers through hard copies or PDF documents.

However, this method is not ideal as it is time-consuming for the borrower; the lender also must process the data using the screen scraping method. Also, such documents are not tamper-proof.

Integrating Account Aggregator with LOS helps process more loan applications in a lesser time and DERISK loan books by getting financial data directly from the source.

In addition, error-prone back-office practices such as screen scraping will make way for secure, high-speed consumer data delivered directly to the lenders via Account Aggregators.

This will also solve the need to monitor loan accounts post-disbursement for early intervention and lower loan loss provision, which will be a significant step up from the traditional manual credit assessment process.

Finezza LOS – AA workflow for Gromor

Gromor Finance is a lending company that provides secured and unsecured financing to unassisted enterprising entrepreneurs of India. Now, being in the lending business, Gromor’s operations rely on analysing the bank account data of clients for accurate credit evaluation.

As part of its efforts to improve its lending process, Gromor recently integrated the Account Aggregator ecosystem into its LOS platform to optimise its efficiency and effectiveness.

Here are the 3 simple steps in which Gromor is fetching & analysing bank account data using an account aggregator via their Finezza LOS portal:

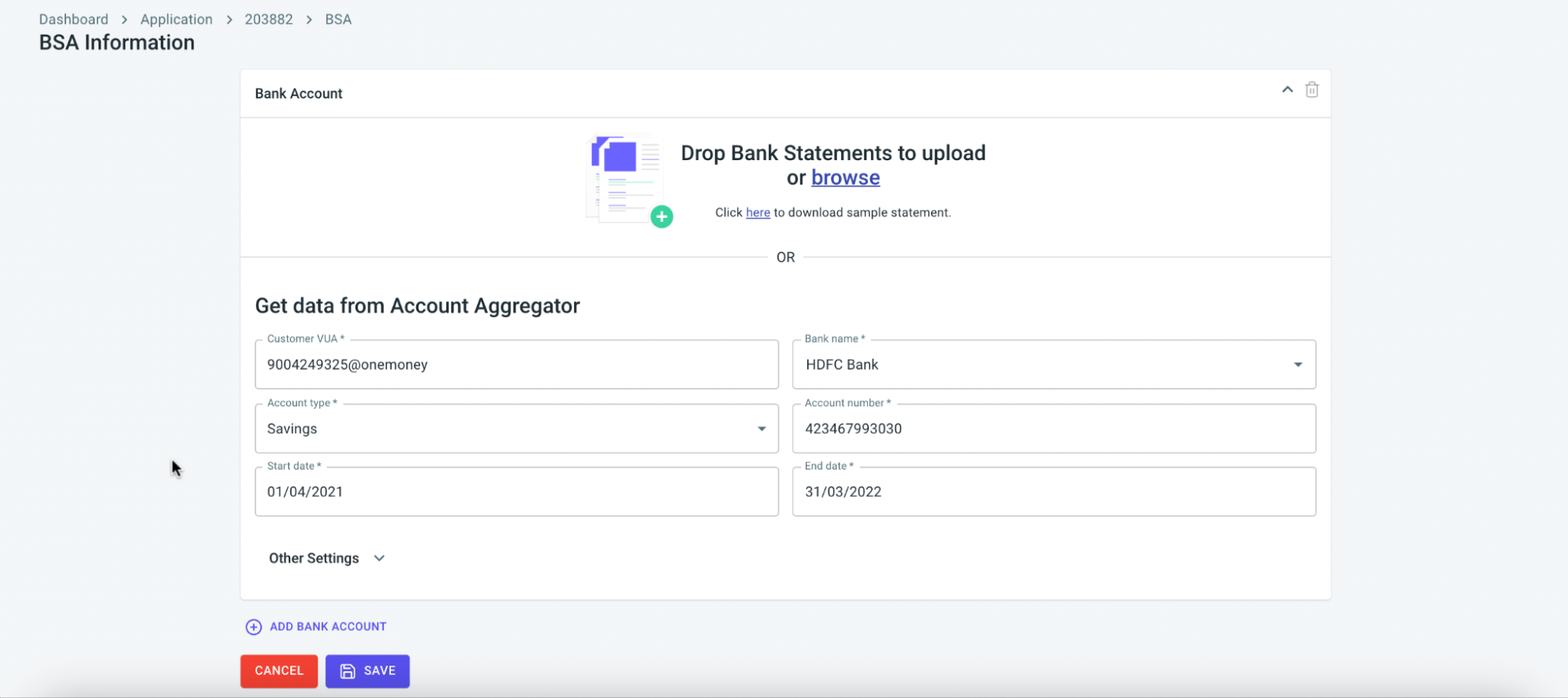

Step 1: Gromor raises a consent to their user from the Finezza LOS portal to the user’s Account Aggregator registered account

Gromor has to enter details such as Customer VUA, i.e., the user’s account aggregator ID, bank account name, account type, account number etc., to raise a consent to fetch bank account data from the User’s Account Aggregator. Other Default settings are configurable as per lenders’ requirements.

Step 2: User has the option to approve or reject the request raised by the lender

Once the consent has been raised, the user has to access their Account Aggregator app, where they’ll see the consent & detailed information that the lender has requested, such as date range, type of data requested etc. Here they’ll have the option to either Approve or Reject the consent raised to access their financial information.

To get registered with an account aggregator, users have to create an account and link their financial accounts to the AA app, against which lenders will raise consent to access their financial information.

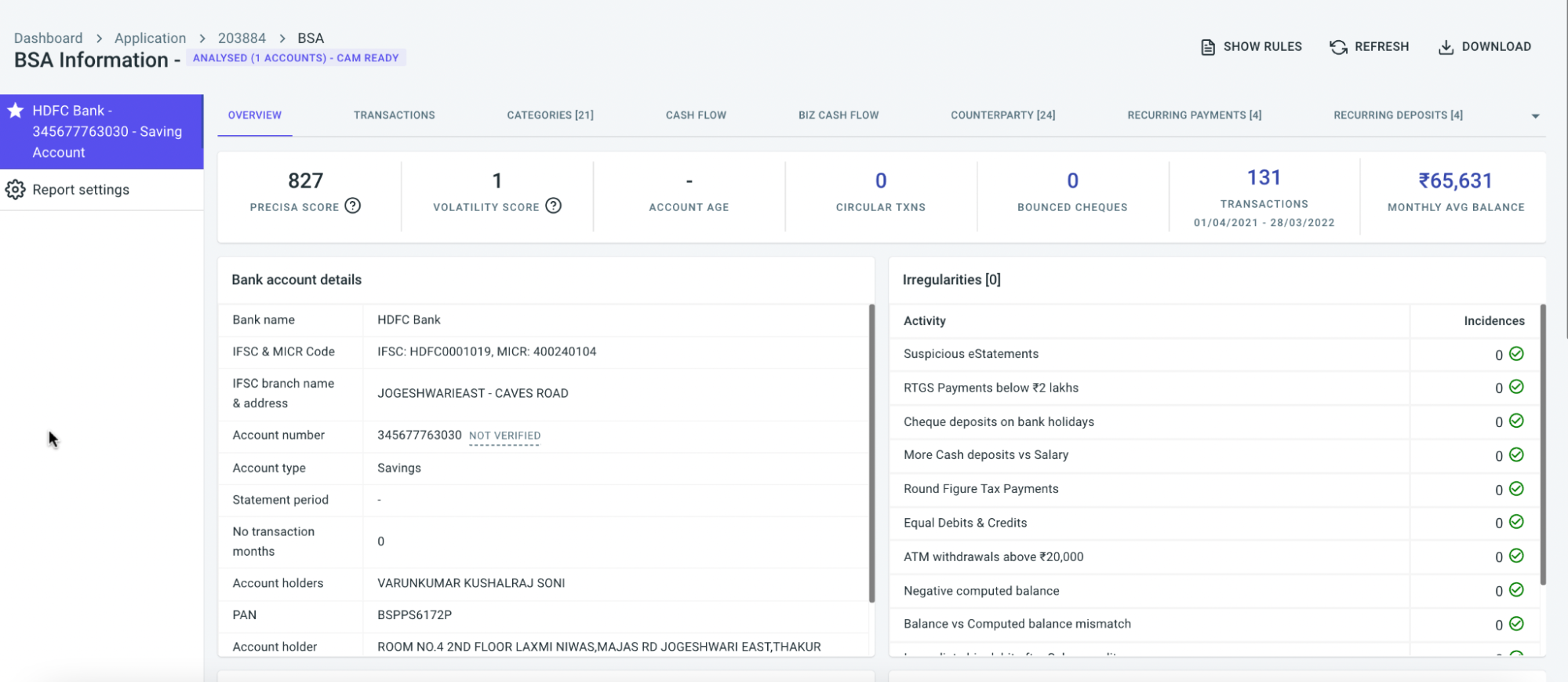

Step 3: On approval, the LOS portal fetches the data from the account aggregator and provides analysis for the period for which consent was raised

Once the consent is approved, the LOS portal fetches the bank account data & provides the analysis as requested. Following these three simple steps, Gromor has been able to process more loan applications in a lesser time, derisk loan books by getting financial data directly from the source, and get error-free bank account analysis.

Once the consent is approved, the LOS portal fetches the bank account data & provides the analysis as requested. The analysis is performed by Precisa [Finezza’s bank statement analyser]. Once Precisa gets the raw bank account data it classifies & categorizes transactions, analyses the data, detects fraudulent transactions and other anomalies, assigns an overall creditworthiness score called Precisa score and presents actionable insights in visually appealing, intuitive dashboards in real-time.

Following these three simple steps, Gromor has been able to process more loan applications in a lesser time, derisk loan books by getting financial data directly from the source, and get error-free bank account analysis.

Contact Finezza today if you are a lender or a loan service provider looking to enhance your current loan origination system by integrating an account aggregator.

We at Finezza provide world-class loan cycle management technologies to assist you in providing the best possible service to your consumers.

Leave a Reply