The launch of the Unified Payments Interface (UPI) network in India in 2016 revolutionised the payments domain. This system enabled instant and secure payments by anyone with a mobile phone and bank account. Since then, digital payments have become the go-to mode of payments across economic strata. The financial year 2022 to 2023 recorded digital […]

How Is Alternative Data Revolutionising Credit Underwriting Software

As the lending industry grows and lenders attempt to scale quickly, lending businesses are at greater risk of making poor decisions inadvertently. Poor decision-making often results in the growth of non-performing assets (NPAs) and potentially funding fraudulent borrowers. Therefore, lenders need access to various data points to make data-driven decisions. Merely evaluating income statements or […]

How Do Virtual Credit Card Numbers Work: Implications for Lenders

The rapid transformation of the financial sector demands innovative digital solutions. To keep up with the pace, lenders are seeking cutting-edge solutions to help deal with modern challenges, such as identity thefts, while ensuring seamless user experiences. Virtual credit cards (VCCs) have emerged as a transformative tool. They offer a solution to the safety problem […]

Slash Loan Processing Time: Tips to Optimize Your Loan Origination Process Flow

The lending industry is considered a key driver of economic growth in India. On the business side, lenders are attempting to fill the credit gap, enabling businesses of all sizes and scales to reach their full potential. On the retail side, timely and affordable loans enable consumers to fulfil various aspirations, from purchasing a home […]

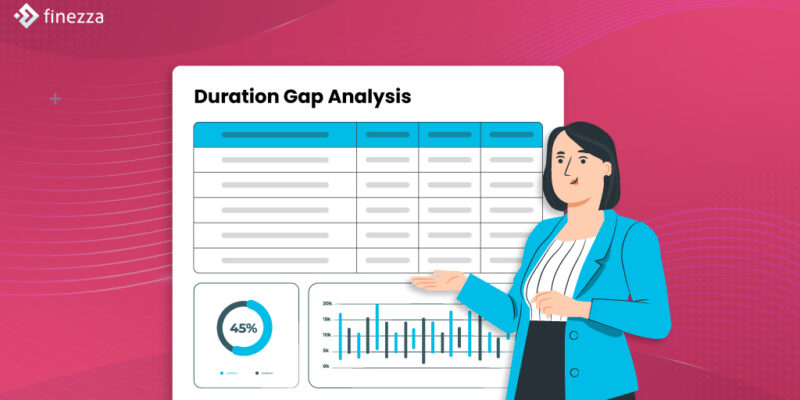

The Role of Duration Gap Analysis in a Lender’s Asset Liability Management

Lenders are often exposed to different types of risks, interest-rate risk being one of them. Interest rate risk stems from unexpected fluctuations in the interest rates in the market due to changes in the monetary policy, inflation and economic growth. Lenders protect themselves from the risk of default by borrowers by carrying out a thorough […]

Digital and Advanced Loan Origination System: A Lender’s Lifeline in the Digital Era

The Indian financial ecosystem is witnessing rapid changes thanks to the increasing demand for technology integration into conventional financial operations. Traditionally, although most banks and other financial institutions claimed to offer top-notch customer service and experiences, the reality painted a different picture. Despite these reassuring claims, banks were gradually – for the wrong reasons. The […]