In the era of information technology, data is the ‘new oil’. It is the essential commodity that drives businesses. The ability to gather, analyse, and use relevant data accurately makes or breaks an organisation in today’s age. Consequently, data security in cyberspace is a critical concern for firms operating in the digital space. Digital lending, […]

Debt Factoring: Is It The Best External Source of Finance in the Short-Term?

It is hardly an overstatement to say that the mechanism of credit sales or deferred payments grease the wheels of trade and commerce. Small and medium businesses, in particular, get a chance to stay ahead of the competition by providing such credit purchase facilities to their customers. This often allows them to cultivate long-term relationships […]

Can A Loan Management System Help Streamline Loan Processing and Approval?

As digitisation and adoption of fintech by consumers grow, lenders need to ensure their processes do not lag due to a lack of access to the latest technology. Generally, the lending process involves multiple steps, from customer onboarding to disbursement. Traditionally, each step is carried out manually, which is time-consuming and often prone to errors. […]

Future Trends in Loan Management Software: AI, Automation, and More

Thanks to technological advancements, loan management software has evolved immensely over the past decade. By 2032, AI and automation market in the banking industry is estimated to be worth USD 182 billion. In today’s digital age, lending institutions seek new and innovative ways to streamline their loan management processes. Artificial intelligence (AI), automation, and blockchain […]

Technology’s Role in Bank Statement Analysis for Better Financial Decisions

The banking industry has constantly evolved, and technology has played a significant role in its transformation. The fintech or financial technology market is forecast to reach USD 699.50 billion by 2030, representing a 20.5% CAGR. One key area where technology has significantly impacted is bank statement analysis. Financial companies, banks and NBFCs thoroughly evaluate customers’ […]

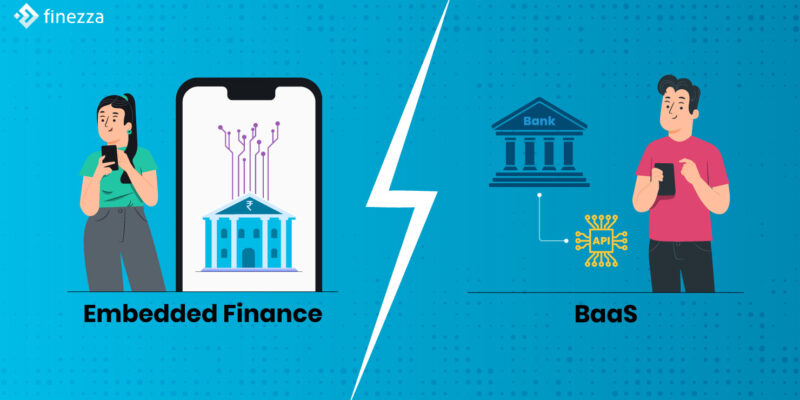

Embedded Finance vs BaaS: Differences Traditional Finance Service Providers Need to Know

Digitisation has influenced industries and consumer behaviour across the board; however, its impact on the financial services sector has been exceptional. For example, Embedded finance and Banking as a Service (BaaS) are two digital trends contributing to technology-led transformation in the banking sector. Often BaaS and embedded finance are mistaken to be the same as […]