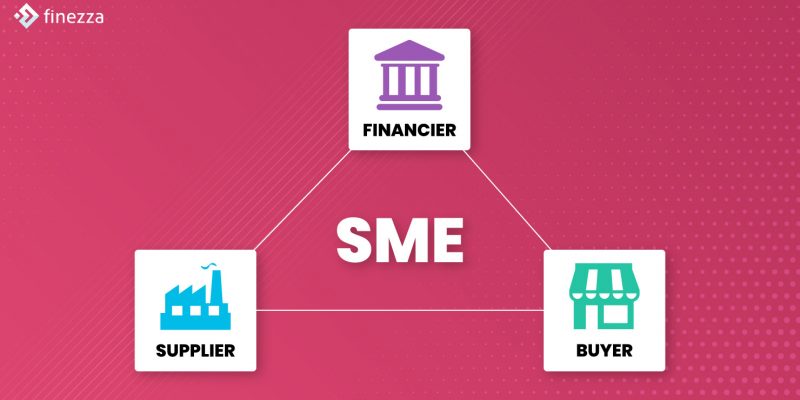

2020 has been a tough year for small and medium enterprises (SME) in India. With B2B customers delaying invoice payments well beyond the usual Net30 or Net60, i.e 30 to 60 days after the due date, maintaining liquidity became a huge challenge for suppliers. On the other end of the spectrum, many start-ups and small […]

6 Ways Digitisation Can Help Curb Loan Defaults in 2021

Lending is the engine that powers the financial growth of all businesses and individuals all over the globe. As the global economies get interconnected and interdependent more every day, the need for funding has also increased enormously. The number of retail borrowers, SMEs, and business borrowers has surged multifold in the last decade. Though this […]

Can AI Help Banks to Simplify Student Loan Management?

Student loans are one of the most popular types of loans that banks offer. Traditionally, student loans were given to aspirants who plan to do their graduation or post-graduation to cover their expenses like tuition fees, books and supplies, and living costs. With tougher competition in the global job market in the last decade, the […]

Virtual vs In-Person: Are Loan Management Systems Reliable?

Lending is the lifeline that fuels the financial growth of all businesses and individuals. In such a scenario, having a robust lending system becomes imperative for the overall growth of the economy. As the entire global financial systems make a rapid shift towards digitisation, this has forced the lending industry to look beyond the traditional […]

Neobanks for Teenagers: A New Opportunity in India’s Financial Horizon

Neobanks are financial technology-based banks that operate totally in the digital and mobile space. As of 2020, Neobank is still a relatively newer terminology and less understood by most of the traditional banking customers. Nevertheless, it is slowly but steadily gaining its popularity among teenage banking customers in India and also across the globe. What […]

The Future of Blockchain and Cryptocurrency in India

Gartner, a leading research and advisory company, had predicted that the banking industry will derive 1 billion dollars of business value from the use of blockchain-based cryptocurrencies by 2020. Moreover, blockchain can be used for launching new cryptocurrencies that will be regulated or influenced by monetary policy. While 2020 has been topsy-turvy for most industries, […]