According to the Reserve Bank of India’s (RBI) latest data on ‘Sectoral Deployment of Bank Credit’, credit outstanding toward the housing sector increased to around ₹10 lakh crore between 2022 and 2024. Further, the segment of housing loans is expected to account for about 13% of India’s GDP by the end of 2025 against 12.3% […]

5 Reasons Why Traditional Lending Operations Cost 5x More Than Software-Enabled Lending

India’s digital lending market, projected to reach ₹15 trillion by 2030, is expanding at a CAGR of 25.6%. RBI reports non-food credit increased by 13.9% in 2024 compared to 9.6% in 2022. Yet, many banks depend on conventional processes to satisfy this need. Manual processes like paper-based application forms, in-person and physical document verification, personal […]

Loan Management Software: Must-have AI Features in 2025

RBI’s Financial Stability Report indicates that banks’ gross NPA ratio fell to 2.6% as of September 2024. In ten years, this has been the lowest. Although steady collections and consistent credit growth helped the GNPA ratio drop to 4.0% for NBFCS, the need to preserve asset quality still looms. RBI is keeping an eye on […]

Collection Str͏ategies for Overseas E͏duc͏ation Loan NPAs

The dr͏eam of studying abro͏ad continues͏ to inspire͏ tho͏usands of Indi͏an students each͏ year͏.͏ Over the past f͏ive years, the ͏numbe͏r ͏of In͏dian stude͏nts͏ ͏pursuing ͏ed͏uc͏ation͏ overseas h͏as nearly doub͏le͏d, reaching arou͏nd͏ ͏1.3͏4 million ͏in 2024. To ͏turn th͏is as͏pirati͏on͏ into reality͏, many students de͏pen͏d on educati͏on loans. ͏As ͏of July͏ 2024, the total outstandi͏ng […]

Alternative Credit Scoring in India: Financial Inclusion Guide

Financial inclusion has emerged as a significant opportunity for lenders in India. As of December 2024, World Bank data estimated that India’s credit-eligible population, comprising consumers aged 18 to 80, stood at approximately 1,036 million. However, only 27%, or approximately 277 million consumers, utilised formal credit facilities. Approximately 451 million Indians have limited or no […]

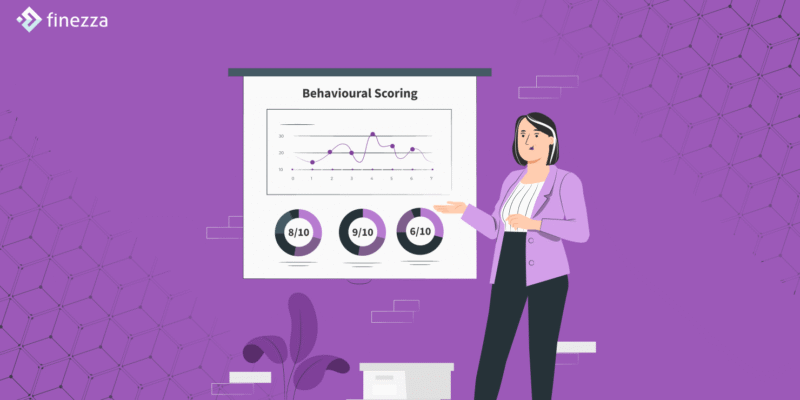

Behavioral Scoring: The Smart Approach to Line of Credit Risk Management

In 2022, around 160 million people in India were credit-underserved. One reason for this is the overreliance on traditional scoring models, which typically consider parameters such as payment history, debt-to-income ratio, and length of credit. However, traditional credit scoring models do not account for an individual’s lack of credit history or other important parameters, including […]