NBFCs across India are preparing for a landscape where speed will decide survival, and delays will drive customers away. The recent industry studies predict that in 2026 over 82% of borrowers will choose lenders who offer fast approvals, while nearly 65% of NBFCs confirm that their biggest struggle is reducing Loan TAT. With rising application […]

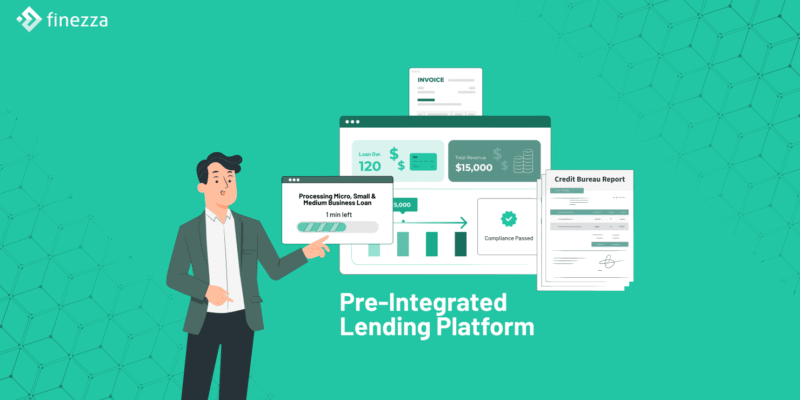

How Pre-Integrated Lending Platform Accelerate Time-to-Market

Pre‑integrated lending platform solutions are rewriting the rules of digital lending. Lenders historically built bespoke systems with long implementation cycles, manual processes and rising costs. In a market where borrowers expect instant credit decisions, these delays are costly. Statistics show that India’s digital lending market could reach ₹15 trillion by 2030 with a 25.6 % […]

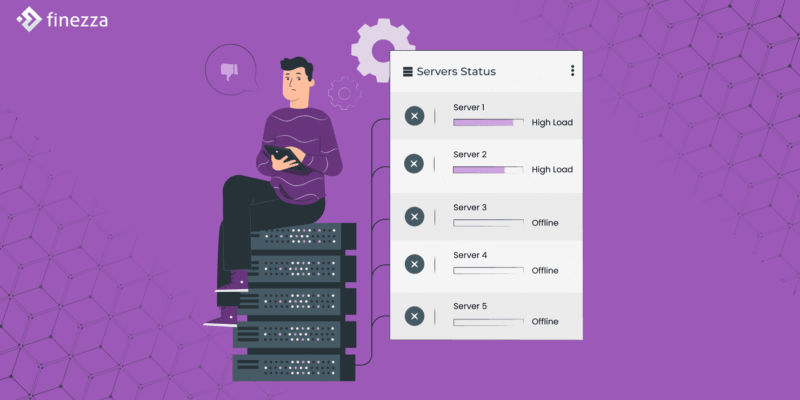

Integration Debt: The Silent Killer of Lending Technology Roadmaps

Rapid innovation is reshaping the financial landscape; however, the success of lending technology roadmaps hinges on seamless integration with existing systems. Integration challenges can undermine even the most advanced solutions. This is particularly evident in the Indian context, where technology investment patterns reveal unique challenges and opportunities. A report in Business Standard highlighted that many […]

No Mor͏͏e Pr͏͏e-Paymen͏͏t͏ Cha͏r͏ge͏s:͏ ͏H͏o͏w RBI’s ͏Latest Dire͏ctive Affec͏ts Your Floa͏tin͏͏g͏ ͏Rate ͏L͏o͏an Portfol͏io

The͏ Reserve Bank of India (RBI) ͏ha͏s anno͏unced a landmark m͏ove that wil͏l re͏define how bo͏rrowers manage debt. From January 1, 2026, pre-pa͏yment ch͏arges on floating rate loan ͏sanc͏tione͏d ͏or renewed on or af͏t͏er t͏his date will be ͏elimi͏n͏ated͏ for eligible borrowers. ͏This change, outl͏ined ͏in͏ ͏the RBI’s Pre-payment Charges on Loans Directions, is designed […]

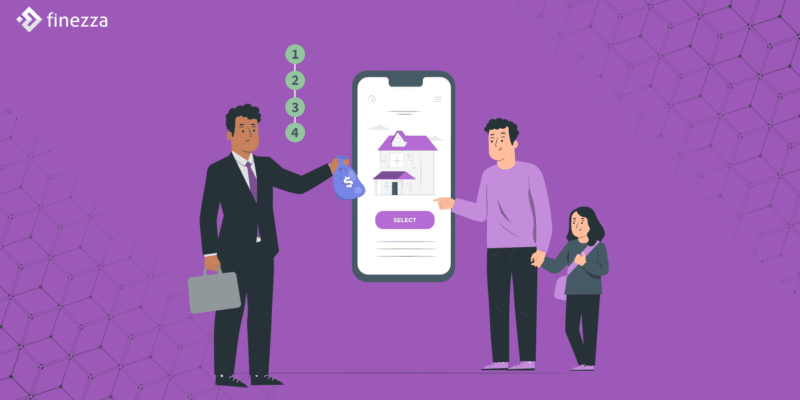

4 Important Components of Technical Verification in Housing Loans

According to the Reserve Bank of India’s (RBI) latest data on ‘Sectoral Deployment of Bank Credit’, credit outstanding toward the housing sector increased to around ₹10 lakh crore between 2022 and 2024. Further, the segment of housing loans is expected to account for about 13% of India’s GDP by the end of 2025 against 12.3% […]

5 Reasons Why Traditional Lending Operations Cost 5x More Than Software-Enabled Lending

India’s digital lending market, projected to reach ₹15 trillion by 2030, is expanding at a CAGR of 25.6%. RBI reports non-food credit increased by 13.9% in 2024 compared to 9.6% in 2022. Yet, many banks depend on conventional processes to satisfy this need. Manual processes like paper-based application forms, in-person and physical document verification, personal […]