According to the Reserve Bank of India’s (RBI) latest data on ‘Sectoral Deployment of Bank Credit’, credit outstanding toward the housing sector increased to around ₹10 lakh crore between 2022 and 2024. Further, the segment of housing loans is expected to account for about 13% of India’s GDP by the end of 2025 against 12.3% […]

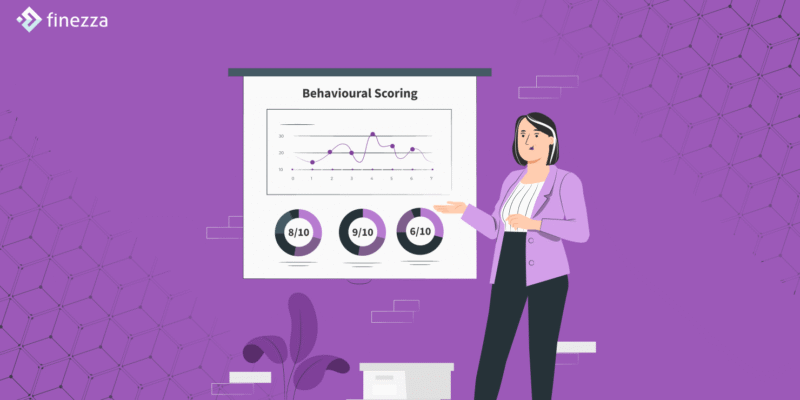

Behavioral Scoring: The Smart Approach to Line of Credit Risk Management

In 2022, around 160 million people in India were credit-underserved. One reason for this is the overreliance on traditional scoring models, which typically consider parameters such as payment history, debt-to-income ratio, and length of credit. However, traditional credit scoring models do not account for an individual’s lack of credit history or other important parameters, including […]

Future of P2P Lending and Its Direct Impact on Loan Origination Systems

Peer-to-peer (P2P) lending became a global phenomenon after the 2008 financial crash, emerging as a reliable alternative to traditional financial institutions including banks. While P2P lending businesses started entering the Indian market in 2014, it wasn’t until 2017 when the Reserve Bank of India (RBI) issued guidelines suggesting that all P2P service providers must be […]

Some Ethical Considerations in AI-Driven Bank Statement Analysis

Artificial intelligence (AI) is set to become an integral part of the financial landscape, including balance sheet analysis for decision-making. AI-powered solutions can help lenders improve efficiency by reducing processing time and increasing productivity. While its integration offers numerous benefits, the use of AI in the financial domain also raises some ethical concerns like the […]

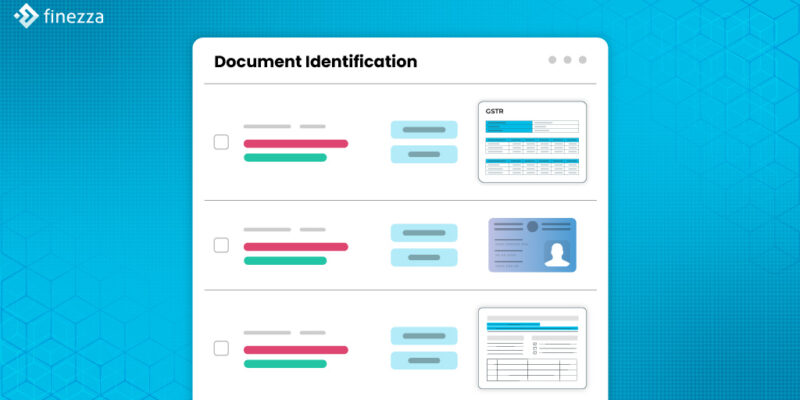

Finezza’s Document Identification Framework: Enhancing Lender Accuracy

When potential borrowers apply for a loan, they must submit a wide range of documents, from identity documents to financial documents such as bank statements. As the number of loan applicants escalates and the volume of documents grows, lenders face a unique challenge. They struggle to extract raw data efficiently, accurately, and quickly from such […]

Customer Onboarding Automation for Contactless Service

Know Your Customer (KYC) is the process by which a lender verifies a customer’s identity and other information using documentation such as PAN Card, Driver’s License, Voter ID, GST Registration, Aadhar Card and so on. Customer onboarding has traditionally been a costly affair with physical collection of documents and in person verification, which when coupled […]