The greatest benefit of the amalgamation of digital technologies is that data from various sources can be brought together in one place for better effectiveness. Even in the world of financial services, cutting-edge technologies that have been introduced have brought a shift in the consumer expectations of speed, safety, and security. This kind of varying […]

How Effective Is It to Automate Your Debt Collection?

No matter how big or small your business operations are, managing cash flow can be quite challenging. For instance, since the Great Recession in 2009 in the US the consumer debt had increased nearly by USD 2.3 trillion and now with the pandemic, it is even getting more difficult to recover debts. Business turnovers have […]

Account Aggregators: Putting the Consumer First

To jumpstart economic growth in the post-pandemic environment, simplifying access to business loans for SMEs is a critical first step. The truth is India still lags behind the global average when it comes to loan origination and disbursal. According to a report by TransUnion CIBIL and SIDBI, the average turnaround time for a business loan […]

Should India Consider Introducing Digital-Only Bank Licenses?

Today banking has become an integral part of everyone’s financial activity, and digital banks in India have advanced to a greater extent. Digital-only banks are transforming the way customers used to view banking operations. New digital-only banks, also known as the neobanks, are being launched worldwide, including the US, Canada, UK, Germany, Hong Kong, and […]

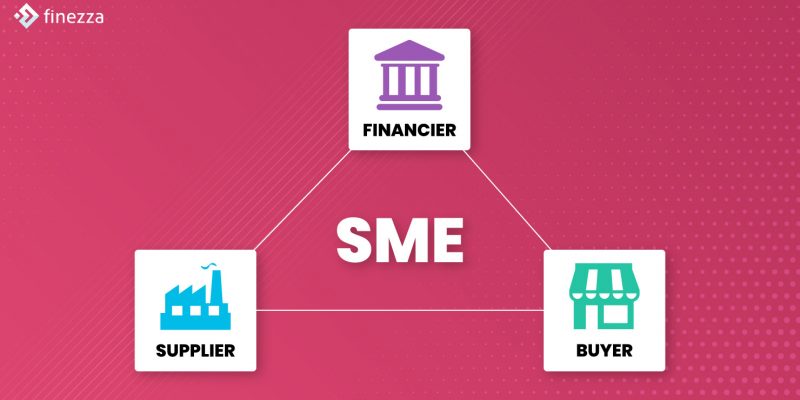

5 Ways in Which Supply Financing Can Change the Way SME Get Financed

2020 has been a tough year for small and medium enterprises (SME) in India. With B2B customers delaying invoice payments well beyond the usual Net30 or Net60, i.e 30 to 60 days after the due date, maintaining liquidity became a huge challenge for suppliers. On the other end of the spectrum, many start-ups and small […]

6 Ways Digitisation Can Help Curb Loan Defaults in 2021

Lending is the engine that powers the financial growth of all businesses and individuals all over the globe. As the global economies get interconnected and interdependent more every day, the need for funding has also increased enormously. The number of retail borrowers, SMEs, and business borrowers has surged multifold in the last decade. Though this […]