Treasury teams at NBFCs and small finance banks manually reconcile ALM data for 8-12 person-days monthly, extracting loan portfolios from LMS platforms, deposit schedules from CBS, and investment holdings from treasury systems. When RBI’s monthly ALM return (Form III) is due, this reconciliation window compresses to 72 hours, forcing teams to work through data mismatches […]

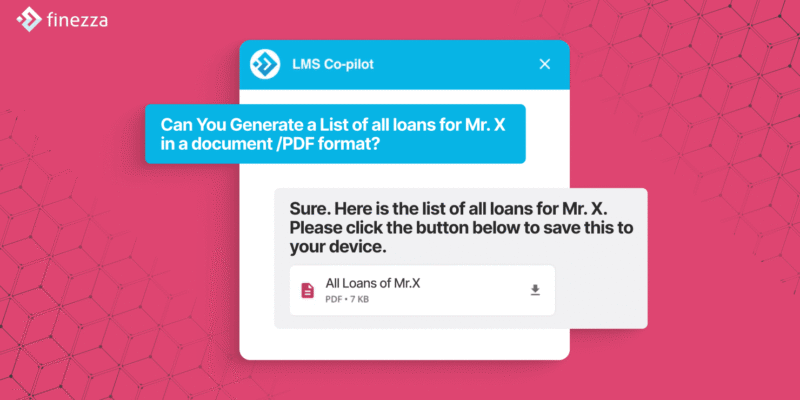

Natural Language Loan Queries: 5 Use Cases from Finezza Co-pilot

Loan officer asks: ‘What’s the outstanding balance on loan 208241?’ Four minutes later, after opening three screens, cross-referencing LOS and CBS data, and manually calculating interest accrued since last payment, they finally have an answer. Multiply this by 200+ daily queries, and 15 productive hours vanish into routine information retrieval. When 35% of new NBFC […]

Why Configurability, Not Just Features, Is the True Measure of Loan Management Software

Your loan officers waste three hours daily reconciling data between systems that should talk to each other. Collections teams maintain shadow Excel trackers because your LMS can’t handle product-specific penalty structures. Credit managers file change requests for business rule modifications that take six weeks to implement. These aren’t edge cases—they’re symptoms of prioritizing feature checklists […]

Top Loan Management Software for NBFCs in India 2026

India’s lending market is expected to reach $2.38 billion by 2030, growing at 30.2% annually. Economic expansion, urbanisation, and rising credit demand are driving loan application volumes that exceed most NBFCs’ manual processing capacity. Legacy systems struggle with regulatory reporting frequency, multi-product portfolio management, and real-time risk assessment requirements. NBFCs processing diverse loan products (MSME, […]

How Fintech Startups Scale with the Right Loan Management Software

Fintech startups are redefining the credit ecosystem—disbursing thousands of loans daily across various borrower segments. However, as volumes surge, traditional processes, reliance on spreadsheets, and disconnected systems begin to show their limitations. Start-ups that scale rapidly without a resilient technology foundation consistently face delayed disbursals, compliance loopholes, and restricted portfolio visibility. To sustain India’s forecasted […]

Foreign Exchange Risk Management in Study Abroad Loan Portfolios

With over 1.33 million Indian students studying abroad, education loans have become vital. According to an Economic Times report, 33% of these students depend on such loans to pursue quality education overseas. Non-banking financial companies (NBFCs) have seen significant growth in education loan assets, rising over 80% in fiscal year 2023 and 70% in fiscal […]