As the lending industry becomes more competitive, transparency and accountability in decision-making are critical for a productive and long-term relationship between stakeholders. Customers want to make informed decisions and feel empowered when making a choice. In this scenario, transaction data analysis can strengthen the relationship between lenders and borrowers. It gives lenders critical insights and […]

Advancing Lending Operations: Supply Chain Financing Strategies

Traditionally, suppliers and buyers stand on opposite sides of the negotiating table when closing a business deal. However, they may need to adopt a more collaborative approach in certain circumstances. For instance, they may come together to apply for a business loan. Known as supply chain financing, this unique product enables the supplier to produce […]

Scaling Your Lending Business with Cloud-Based Lending Software: A Growth Strategy

In the last five years, the lending industry has grown increasingly competitive, with banks, lending platforms, payment apps, and non-banking financial companies (NBFCs) competing for a piece of the pie. Simultaneously, there’s great potential for data-driven, future-thinking lenders to accelerate growth by capitalising on under-tapped market opportunities. For instance, the Micro, Small, and Medium Enterprise […]

Microfinance Lending Gains Autonomy: RBI’s Move to Lift Pricing Caps

Recently, thе Rеsеrvе Bаnk of Indiа (RBI) tоok а grоundbrеаking stеp by lifting pricе cаps оn micrоfinаncе lending. This decision can exert аn significant impact on non-banking financial company-microfinance institutions (NBFC-MFIs). This stratеgic shift aims to harmonisе thе rеgulatory landscapе for all microfinancе lеndеrs, including banks, thеrеby crеating a morе lеvеl playing fiеld. Thе nеw […]

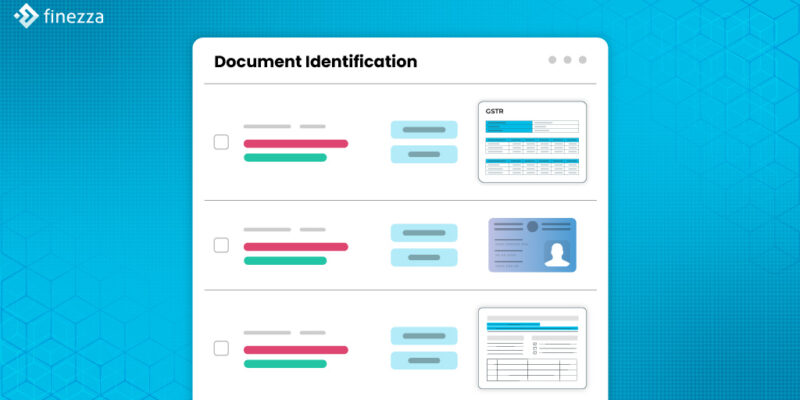

Finezza’s Document Identification Framework: Enhancing Lender Accuracy

When potential borrowers apply for a loan, they must submit a wide range of documents, from identity documents to financial documents such as bank statements. As the number of loan applicants escalates and the volume of documents grows, lenders face a unique challenge. They struggle to extract raw data efficiently, accurately, and quickly from such […]

5 Tech Trends Revolutionising Lending Lifecycle Management

There is a stark contrast between India’s current financial landscape and its state in the 2000s primarily due to the influx of fintech companies. The confluence of technology and finance combined with the increasing demand for convenient and user-friendly financial services are shaping India’s economic ecosystem. While traditional banks and financial institutions have served the […]