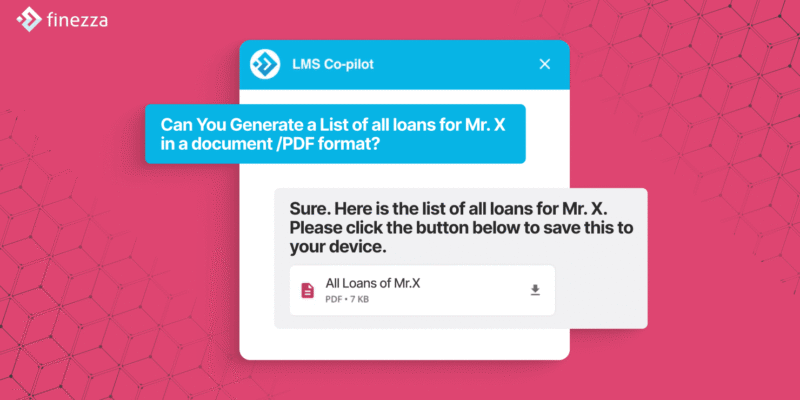

Loan officer asks: ‘What’s the outstanding balance on loan 208241?’ Four minutes later, after opening three screens, cross-referencing LOS and CBS data, and manually calculating interest accrued since last payment, they finally have an answer. Multiply this by 200+ daily queries, and 15 productive hours vanish into routine information retrieval. When 35% of new NBFC […]

Creditworthiness vs Credit Score: What Smart Lenders Actually Look At

A credit score alone cannot determine lending risk. While they provide a snapshot of past borrowing behaviour, they miss critical signals about a borrower’s current financial capacity and future repayment potential. Understanding the distinction between creditworthiness vs credit score is essential for sound lending decisions. A credit score reflects historical borrowing patterns, but it doesn’t […]

Foreign Exchange Risk Management in Study Abroad Loan Portfolios

With over 1.33 million Indian students studying abroad, education loans have become vital. According to an Economic Times report, 33% of these students depend on such loans to pursue quality education overseas. Non-banking financial companies (NBFCs) have seen significant growth in education loan assets, rising over 80% in fiscal year 2023 and 70% in fiscal […]

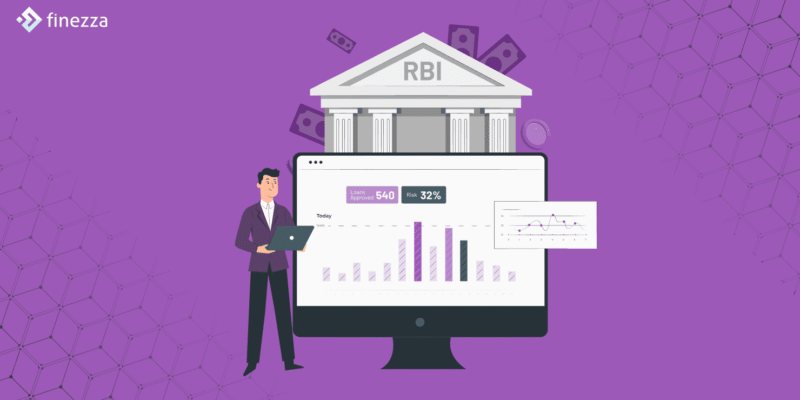

How RBI’s New Loan Rate Rules Transform Your Lending Operations

The Reserve Bank of India (RBI) announced regulatory amendments to the structure governing loan rate rules, lending against gold/silver collateral, and Perpetual Debt Instrument (PDI). Three significant regulatory changes took effect on October 1, 2025; four remain open for consultation until October 20, 2025. The proposed reform aims to modernise the lending framework by easing […]