The past few years have seen the growth of financial services and digitisation via adopting newer methods for wealth management, payments, insurance, and lending. Consequently, the digital lending sector is undergoing a similar transformation to overcome traditional banking pain points and highlight financial inclusion by offering individuals, and businesses access to financial services and products. […]

A Deep-dive Into Finezza’s Credit Bureau Analyser

The demand for superior credit bureau analysis is higher than ever as the financial lending industry grows exponentially all over the globe. Moreover, with so many mobile and web-based quick loan options available in the market, it has become straightforward for the borrower to get fast money for personal needs or businesses. As the number […]

How Finezza’s Delinquency Management Helps Streamline Loans?

Effective delinquency management is a looming concern for lenders of all types and sizes. Every lender’s operations may account for some level of loan delinquency. But if that level becomes too high, it can negatively affect your business, including increased collection costs, reduced profitability, and reputational risk. According to reports by a credit information bureau, […]

How Finezza’s Comprehensive Analytics Simplifies Risk Management

India’s banking sector and NBFCs have played a pivotal role in addressing the financial needs of individuals and businesses across industries. These institutions have adopted agile processes by developing innovative financial products that cater to niche markets and bring mainstream lending to the forefront. Risk management, a principal factor in the financial sector, emerges as […]

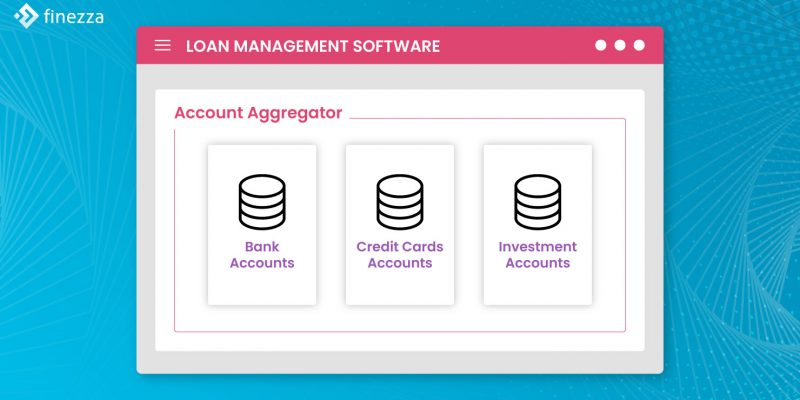

Why Your Loan Management System Needs an Account Aggregator Integration?

It is rare to see that all of the financial holdings of a borrower are in one place. The bulk of the time, they are scattered among various intermediaries and most likely fall within the jurisdiction of ten different regulators. For instance, a customer can have fixed deposits in three different banks, each under RBI’s […]

How Lenders Can Benefit from Automated Loan Processing Systems

An automated loan processing system has become a strategic necessity for modern lenders, not just a technological upgrade. With rising default rates, shrinking creditworthy segments, and heightened customer expectations for digital-first experiences, traditional loan workflows can no longer keep up. Manual data entry, fragmented systems, and paper-heavy processes introduce delays, errors, and compliance risks that […]