Non-Banking Financial Companies (NBFCs) are making a behind-the-scene yet significant impact on the Indian economy. Despite not having a traditional banking license, they promote financial inclusion, support economic development, enhance innovation, and deepen financial markets. A report by the Reserve Bank of India (RBI) reveals that the share of NBFCs in the total credit extended […]

How Commercial Loan Management Software Powers Digital Transformation

The demand for rapid access to credit in business is continually growing. Businesses across all segments, but especially in the Micro, Small & Medium Enterprise (MSME) segment, seek access to funds to accelerate business growth. Experts predict that business loans to MSME borrowers will rise by 20% in the festive season, especially as consumer spending […]

Decoding the Right Loan Recovery Software: On-premise vs SaaS

Salesforce changed the course of the enterprise-grade loan recovery software industry when the company rolled out a software-as-a-solution (SaaS) CRM in 1999. Over the next few decades, cloud-based SaaS solutions garnered immense popularity, replacing on-premise solutions across various sectors. A Gartner study projected that global SaaS spending will likely reach $195 million by the end […]

How Automated Loan Processing System Is Helping Lenders Cut Costs

The lending industry has grown exponentially in the last few years. A mix of automated loan processing system, banks, and Non-Banking Financial Companies (NBFCs) are aggressively growing their loan verticals. On top of that, several payment platforms and eCommerce companies are also entering the highly competitive lending space. In the third quarter of 2023, digital […]

Managing Credit Risk Analysis and Scoring Using Lending Management Software

Credit risk analysis is a vital process that helps lenders assess the possibility of the borrower defaulting and the loss they may incur if the borrower fails to repay the contractual loan obligations. It often goes beyond credit analysis, primarily focusing on the borrower’s creditworthiness. In contrast, credit risk analysis assists a lender in achieving […]

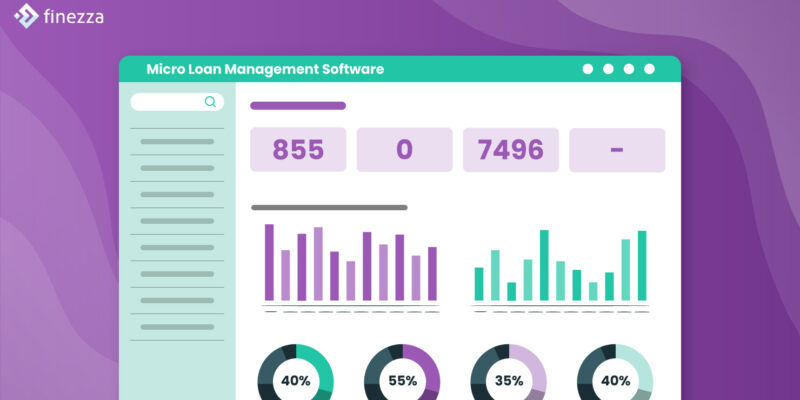

5 Key Features for Choosing Micro Loan Management Software

Micro loans play a crucial role in promoting financial inclusion and aiding small businesses. However, as demand rises, managing them becomes complex. To address this challenge, financial institutions adopt micro loan management software, an advanced tech solution that accelerates the loan origination and lifecycle process. According to a recent report by Grand View Research, the […]