For years, businesses have used credit lines to cover working capital requirements and take advantage of the prevailing investment possibilities. Line of Credit is adaptable, attempting to address a few issues of traditional MSME credit solutions. The credit requirements of MSMEs (e.g., retail businesses, merchants, and wholesalers) reflect the unpredictable business setting in which they […]

The Future of SME Digital Lending Beyond COVID-19 Relief Phase

The COVID-19 pandemic has disrupted the growing world of small and medium-sized enterprises (SMEs). As with so much else in the downturn, the rules for the lending industry supporting these businesses need to be re-written. SME lending is a vital form of external finance to sustain small businesses and meet their cash flow and investment […]

Asset Based Vs. Cash Flow Lending: Understanding Differences

Access to credit is essential for business continuity and growth—especially for small and mid-sized enterprises navigating cash flow gaps or funding expansion. Short-term financing solutions such as cash flow lending offer a lifeline during uncertain periods and enable long-term progress when applied strategically. Today’s most widely used lending models are cash flow loans and asset-based […]

Is Cash Flow Lending the New Opportunity for SMEs?

The term ‘cash flow’ refers to the movement of money in and out of businesses. All the enterprises rely heavily on borrowed money from other commodities to actively function daily. Businesses derive the amount from their revenues as well as take it as loan from banks or other acquisitions. While applying for loans, the enterprises […]

What is Embedded Finance – Innovation That Took The Fintech World by Storm?

Every company at some point needs integrated financial services as a part of its service offering. Integrated financial services is an umbrella term that comprises different aspects related to finance such as payments, insurance, investments etc. This need was widely recognised as ‘Embedded Finance’. With the widespread adoption of digital technology by consumers across industries, […]

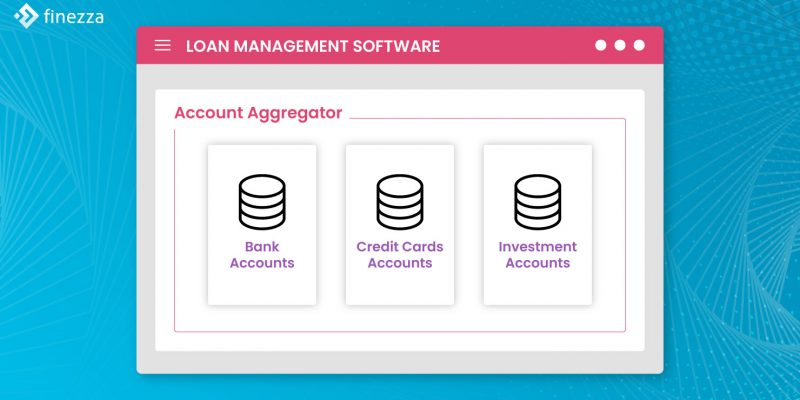

Why Your Loan Management System Needs an Account Aggregator Integration?

It is rare to see that all of the financial holdings of a borrower are in one place. The bulk of the time, they are scattered among various intermediaries and most likely fall within the jurisdiction of ten different regulators. For instance, a customer can have fixed deposits in three different banks, each under RBI’s […]