NBFCs across India are preparing for a landscape where speed will decide survival, and delays will drive customers away. The recent industry studies predict that in 2026 over 82% of borrowers will choose lenders who offer fast approvals, while nearly 65% of NBFCs confirm that their biggest struggle is reducing Loan TAT. With rising application […]

Are You Reading Credit Bureau Reports Wrong? 5 Critical Data Points Lenders Miss

You approved a borrower with a 750 credit score, perfect payment history, and 35% utilisation. Three months later, they defaulted. If your lending institution is facing similar incidents more often, you are probably missing evaluating the critical data points in credit bureau reports. According to RIS (Research and Information System for Developing Countries), unsecured loans […]

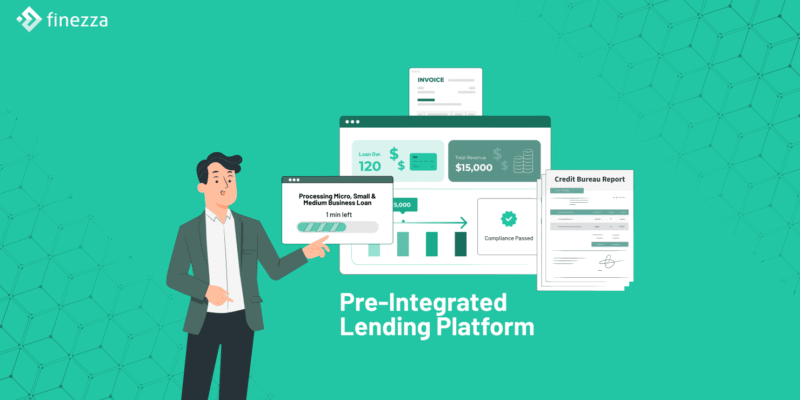

How Pre-Integrated Lending Platform Accelerate Time-to-Market

Pre‑integrated lending platform solutions are rewriting the rules of digital lending. Lenders historically built bespoke systems with long implementation cycles, manual processes and rising costs. In a market where borrowers expect instant credit decisions, these delays are costly. Statistics show that India’s digital lending market could reach ₹15 trillion by 2030 with a 25.6 % […]

Fraud Detection in Loan Origination: AI-Powered Red Flags That Matter

Every time a bank processes a new loan application, it brings both growth and risk. As digital banking expands, loan fraud is growing just as fast. According to a 2024 TransUnion report, online fraud attempts within financial services increased 17.2% worldwide over the last year. This sharp increase highlights a critical gap – conventional fraud-detection […]

How Modern Loan Origination Software Can Cut Your Approval Time by 60%

Loan origination has evolved from a paper-heavy, weeks-long process to a digital-first experience where borrowers expect instant decisions and transparent communication. As borrowers become accustomed to real-time digital services, expectations around speed and transparency are reforming lending standards. The global digital lending platform market was valued at USD 10.55 billion in 2024 and is projected […]