The MSME sector has long been the beating heart of the Indian economy, contributing over 30% to GDP and accounting for almost half of the country’s exports. However, despite these impressive figures, access to formal credit is one of the greatest barriers for MSMEs, specifically the micro and small levels. The Indian government has steadily […]

Micro LAP: The Future of Small Ticket Lending for Lenders

In the small-ticket lending market, Micro Loan Against Property (Micro LAP) serves as foundational support for lenders and financial institutions. It allows them to cater to the underserved segments with a secure and flexible way to access funds. By using loan applicants’ residential or commercial property as collateral, Micro LAP provides instant credit access to […]

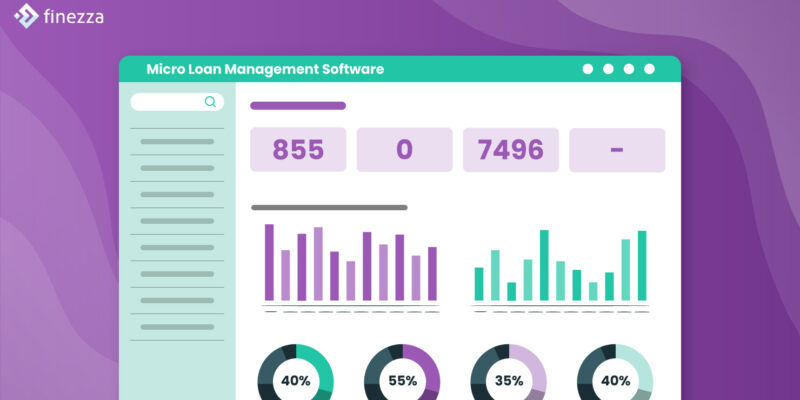

How Does Micro Loan Management Software Improve Lenders Profitability?

According to experts, microfinancing has been one of the most instrumental factors in facilitating financial inclusion in India. The Bharat Microfinance Report by Sa-dhan highlights that 98% of microfinance institution (MFI) borrowers are women, demonstrating the significant role MFIs play in empowering women entrepreneurs through micro-credits. This impact is further underscored by data from the […]

Unlocking Financial Inclusion with Microloan Management Software

Historically, poor credit penetration results in the marginalised sections of society like low-income households, women and Micro, Small, and Medium Enterprises (MSMEs) being excluded from the formal lending channels. However, the MSME sector plays a critical role in the economic development of India. The share of MSME Gross Value Added (GVA) in India’s Gross Domestic […]

5 Key Features for Choosing Micro Loan Management Software

Micro loans play a crucial role in promoting financial inclusion and aiding small businesses. However, as demand rises, managing them becomes complex. To address this challenge, financial institutions adopt micro loan management software, an advanced tech solution that accelerates the loan origination and lifecycle process. According to a recent report by Grand View Research, the […]

Microfinance: What Lenders Should Consider While Approving a Microloan

Microfinance is generally associated with financial inclusion and poverty alleviation. It aims to help individuals and small businesses who have limited access to conventional banking services. In a broader sense, microfinancing refers to providing financial services like access to money transfers and savings accounts, credit facilities, and insurance to the economically weaker segments (EWS) of […]