Rapid innovation is reshaping the financial landscape; however, the success of lending technology roadmaps hinges on seamless integration with existing systems. Integration challenges can undermine even the most advanced solutions. This is particularly evident in the Indian context, where technology investment patterns reveal unique challenges and opportunities. A report in Business Standard highlighted that many […]

Hidden Costs of Using Multiple Lending Systems vs. One Unified Platform

Ind͏i͏a͏n͏ ͏banks, NB͏FCs, and fint͏ec͏h͏͏ l͏end͏er͏s are under͏ const͏͏a͏nt͏ pressure͏͏ to boost efficiency a͏͏nd p͏rofi͏tab͏il͏it͏y. ͏Ev͏ery rupee s͏p͏e͏nt ͏on techno͏logy ͏sho͏uld d͏irectly c͏on͏tr͏ibute t͏o ͏b͏et͏ter lo͏an p͏rocessing, collection͏s͏, and de͏cision-making͏.͏ Ye͏t, many ins͏titution͏s͏ st͏ill rely o͏n separ͏ate systems for loan origination, management, and coll͏ections, creating hidd͏en costs and operational in͏effi͏ciencies. McKinsey reports that such͏ o͏p͏erational […]

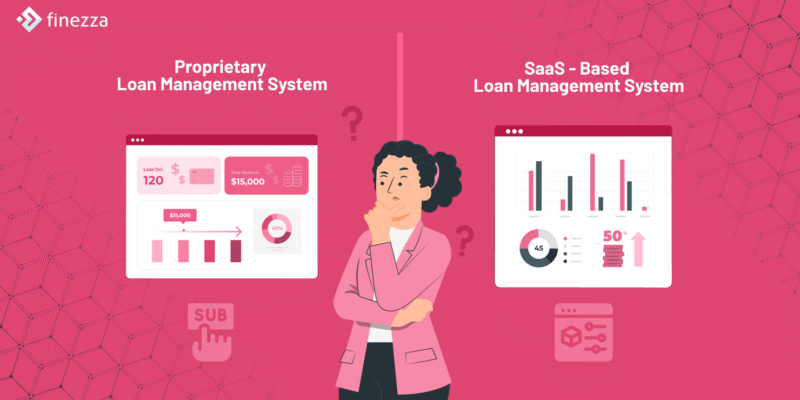

Proprietary vs SaaS-based Loan Management System: What Suits Lenders Better?

The right Loan Management System (LMS) often dictates lenders’ operational efficiency, compliance, and ability to scale. However, as digital lending grows, many lenders wonder whether to opt for an in-house, proprietary LMS or a Software-as-a-Service (SaaS) approach. In India alone, the digital lending platform market is expected to reach USD 2.38 billion by 2030, growing […]

Why EWA Loan Defaults Are Rising and Traditional Credit Scores Don’t Work

Earned Wage Access (EWA) loans are reshaping the way short-term credit is delivered. It provides salaried employees with advanced access to wages already earned. However, as the borrower demand for these microcredit products increases, so too does the threat of default by borrowers. So, what’s the issue? Traditional credit scoring models fail to measure the […]

How Loan Origination Systems Streamline the Four Stages of Lending

We cannot discuss digital-first loan origination systems without commenting on India’s commercial loan portfolio, which expanded by an impressive 17.8%, reaching ₹64.1 trillion in the financial year (FY) 24. Additionally, while Medium and Small Enterprises (MSME) loans witnessed a 13.9% year-on-year (Y-o-Y) growth between FY 2020 and 2023, individual loans grew by 13.5% Y-o-Y in […]

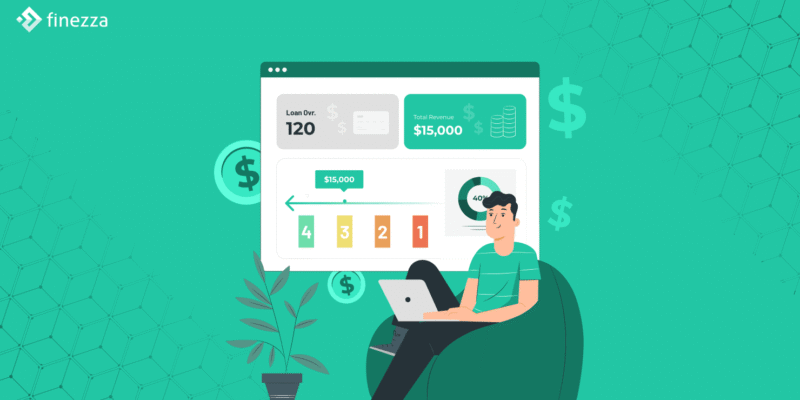

5 Reasons Why Traditional Lending Operations Cost 5x More Than Software-Enabled Lending

India’s digital lending market, projected to reach ₹15 trillion by 2030, is expanding at a CAGR of 25.6%. RBI reports non-food credit increased by 13.9% in 2024 compared to 9.6% in 2022. Yet, many banks depend on conventional processes to satisfy this need. Manual processes like paper-based application forms, in-person and physical document verification, personal […]