As the world plunges into a climate emergency and the worst pandemic of the century ushers in a monumental change in the way businesses work, paperless ought to take a central role. The IDC, for instance, predicted, 400 billion fewer pages will be printed in 2020, thanks to the pandemic-induced isolation and rush to digitise. The […]

How Finezza’s Comprehensive Analytics Simplifies Risk Management

India’s banking sector and NBFCs have played a pivotal role in addressing the financial needs of individuals and businesses across industries. These institutions have adopted agile processes by developing innovative financial products that cater to niche markets and bring mainstream lending to the forefront. Risk management, a principal factor in the financial sector, emerges as […]

What Does Embedded Finance and APIs Mean for the Lending Industry?

Never before have the times been more volatile and dynamic as now. Recession coupled with regulatory pressures, financial reforms, and the recent global pandemic has not made anything easier for the legacy lending industry. As a result, the lending industry faces several challenges while approving and disbursing loans. Cultural Shift: Traditional lending institutions work through […]

8 Benefits of Cloud-based Loan Origination and Loan Management System

In today’s commercial lending market, cloud-based solutions are increasingly serving loan origination and loan management requirements, shifting from manual operations to cloud automation built on the premise of easy access, scalability, and speed. As financiers signal their increased appetite for consumer lending, it is important to speed up digitisation and cater to the newer generation […]

Asset Based Vs. Cash Flow Lending: Understanding Differences

Access to credit is essential for business continuity and growth—especially for small and mid-sized enterprises navigating cash flow gaps or funding expansion. Short-term financing solutions such as cash flow lending offer a lifeline during uncertain periods and enable long-term progress when applied strategically. Today’s most widely used lending models are cash flow loans and asset-based […]

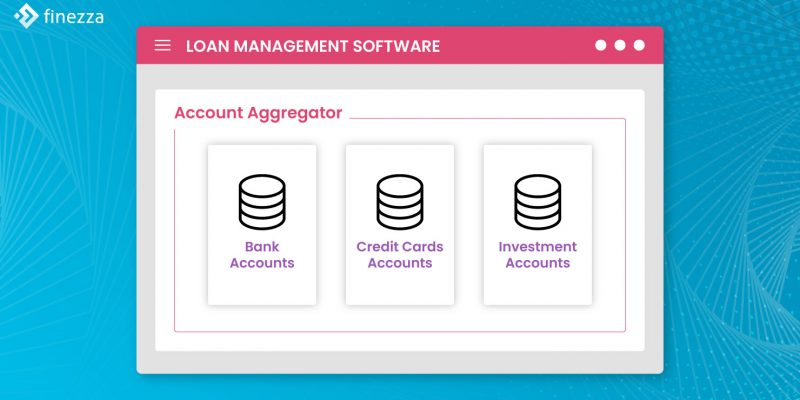

Why Your Loan Management System Needs an Account Aggregator Integration?

It is rare to see that all of the financial holdings of a borrower are in one place. The bulk of the time, they are scattered among various intermediaries and most likely fall within the jurisdiction of ten different regulators. For instance, a customer can have fixed deposits in three different banks, each under RBI’s […]