There’s a lot of buzz going around embedded finance. It has surely emerged as a phenomenon in the last few years. If it is a challenge to traditional banking could be the next puzzle. Before we clear that air for you, let us look at the last financial year and what it has to say. […]

9 Features that make an Outstanding Loan Management Software in 2021

50% of people who want a loan and have access to the internet in India prefer to buy it online. It is stats like these that prove today’s consumer wants the ease of swift loans available without the hassle of dozens of bank visits. And this demand is not limited to loan origination. They want […]

How Effective Are Online Loan Management Systems in India?

TL;DR: Very effective. This is especially true in the aftermath of COVID-19. BCG’s Digital Lending report states that online lending in India will be worth upwards of $1 trillion by 2023. The estimate is evidence that fintech solutions like loan management systems are abundantly useful. It is the benefits they bring to lenders that make […]

Best Gold Loan Management System: Features to Look For

Gold loans have been one of the oldest forms of secured lending in India for centuries. Being a highly liquid asset, gold is the preferred collateral for many lending companies. Several financial institutions, including banks and NBFCs, have gold loans as an integral part of their business lending strategy. Challenges Faced By Lending Institutions in […]

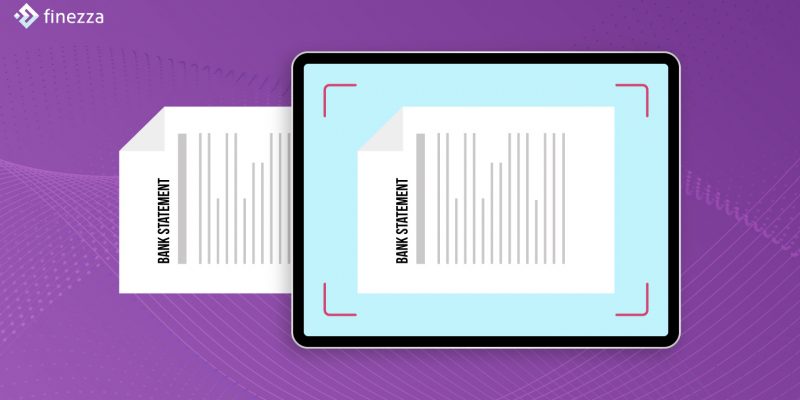

Automate and Scale Your Lending Process with A Bank Statement Analyser

After the pandemic hit the world, loan defaults have been on a steeper rise than before. Direct consumers and SMEs are still struggling to repay loan dues, and the crisis is going away anytime soon. Consequently, a major challenge that all banks and financial institutions face today is tackling the hidden non-performing assets. While retail […]

Top 8 Delinquency Collection Tips for Small Businesses

Being a small business owner, probably you might have learned the definition of “delinquent” – the first time a customer has failed to pay for something on time. Cash flow is necessary for every business and more so for small businesses, especially during your early days. Delinquent customers can negatively impact and profoundly affect the […]