The introduction of Artificial Intelligence (AI) and Machine Learning (ML) is revamping the way businesses and industries function. However, traditional and legacy industries like Banking and Financial Services continue to rely on manually managed processes. Not only are these processes paper-heavy and time consuming but also prone to data breaches and security risks. Traditional lenders remain hesitant in adapting to newer technologies due to concerns like effectiveness, change management and sensitivity of data etc.

Finezza brings along a framework designed to help Indian lenders digitize the lending process on the whole. Not only does this unique tool address the business and compliance concerns of the industry, it also helps lending companies fetch better returns.

Although digitisation in the sector is on the rise, data extraction from documents, especially KYC, is proving to be a challenge for digital lenders. The documents are collected and submitted physically. They are then scanned, uploaded, verified and tagged manually, before being stored in a database. There is always scope for error which affects even lenders who depend on digital platforms.

Growing credit demands in the economy automatically translate into greater demand for manual data extraction in order to maintain accuracy at the lending company headquarters. Not only is manual data extraction inefficient – wasting precious time on the simplest of tasks like extracting Address from an Aadhaar Card – it also takes away the focus of Feet-on-street (FOS) reps from doing something much more important like engaging the customer.

Another drawback of counting on the accuracy of human intervention is the monotony that sets in with repetition, and which ultimately leads to negligence.

To eliminate indexing, quality checks and manual data entry, an OCR-based solution is the right approach to conduct document recognition and data extraction.

To address all these data management problems, exploring technologies like Deep Learning, Object Detection, and Optical Character Recognition (OCR) can be beneficial. These technologies make it easier for lending companies to extract data in a timely fashion and with enhanced accuracy.

How Finezza’s Made-for-India AI & ML backed Document Recognition & Data Extraction Module is Revolutionising the Lending Management Process?

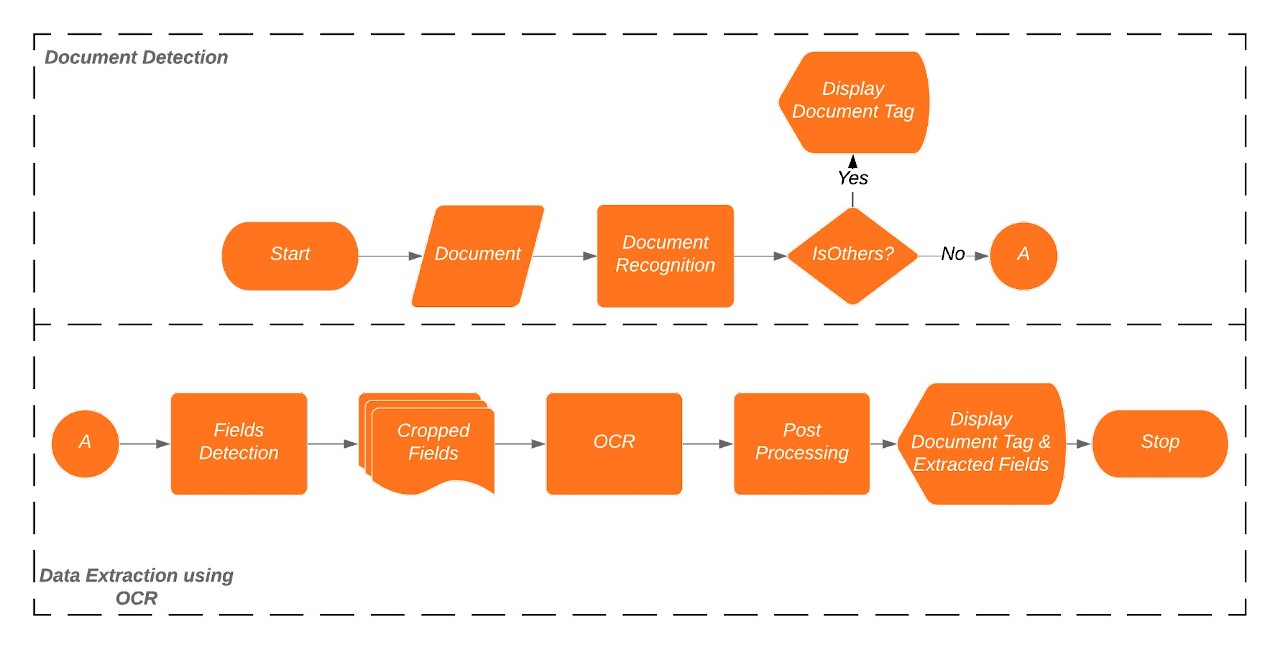

Finezza is a state-of-the-art lending lifecycle management tool that is designed to ease the process for India-based lending companies. Finezza allows loan origination teams to do more than just manually entering subjective data. The unique Document Recognition & Data Extraction Module of Finezza works in two ways:

Document Recognition & Data Extraction

The Finezza framework comes equipped with a robust document recognition module that has been developed using Deep Learning. The software boasts a unique capability of being able to identify the type of document from the following eight types:

-

- Aadhaar Card

- Pan Card

- Cancelled Cheques

- ITR Acknowledgement

- Establishment Photographs

- Balance Sheet

- GST Returns

- Others ( Documents not belonging to the above categories)

Post document recognition, the software tool ensures that field detection is done before Optical Character Recognition (OCR). This is directly opposite to other lending process management tools that apply OCR on the entire document image and then count, during post-processing, to identify the required fields in a document.

Finezza’s data extraction module uses Object Detection techniques to extract the relevant fields and crops the image to reduce the area of interest to small chunks of text. Other lending management tools face limits to their ability to extract subjective fields like Name, Address, etc. which does not have a generalized structure like that of UIDs and Birth Dates.

Thanks to Finezza, the post-processing exercise, is reduced to simple validation, thus ensuring a productive output with high confidence.

| PAN Card | Date of Birth, PAN Number, Name, Father’s Name |

| Aadhaar Card | Address, Aadhaar Number, Name, Date of Birth, Gender |

| Balance Sheet | Date, Name |

| Canceled Cheque | Name, Account Type, Account Number, Bank Name, IFSC |

| GST Return | GSTIN |

| ITR Acknowledgement | Assessment Year |

Conclusion

Using Finezza’s Document recognition and data structuring module, lending companies can drastically reduce the end to end time used to populate the required fields of a document from 1-2 minutes down to 5-10 seconds. Thanks to Finezza, they can quickly identify human biases and correct the same during the loan origination process. The OCR API that the software tool uses excels in terms of accuracy of data extraction from fields like name, date of birth and address etc. In addition to speedy document recognition and data extraction, lenders can skip the need for the next step of cross-verifying and editing incorrect fields. With OCR guided data extraction of Finezza Software, lending companies can increase their operational efficiency and reduce customer onboarding time for the business.

[…] is exceedingly transforming the customer experience each passing day. Lending institutions are fine-tuning their AI solution strategies to reduce operating costs and escalate user experience. Commercial lending businesses can easily […]