The desire to own valuable assets and track debtors have persevered for millennia, and credit lines continue to play a decisive role in the health of economies. For instance, consumer credit has existed since the days of ancient Babylon. Today, as the Information Age progresses, credit has evolved to fit seamlessly into the financial fabric […]

Why Automate and Digitise Credit Risk Management?

Some of the most pressing factors to an urgent need to digitise credit risk management are competition from digitally strong, emerging fintech firms, highly volatile market conditions and cyber security threats that can lead to data privacy issues. The pace of technological disruption has never been stronger than now, and organisations need to ramp up […]

Decoding the Working of Account Aggregators in India (with FAQs)

The introduction of the ‘Account Aggregators’ is said to usher in a new era of India’s financial landscape. However, many analysts view it as a masterstroke strategy by RBI to empower and strengthen the data transfer needs of various stakeholders involved. Designed to help millions of customers get digital access to their data and help […]

How Account Aggregators can Lead to Safe Lending Decisions

Before disbursing loans to individuals and organisations, the first thing any banks or lenders do is to vet their financial situation and lending eligibility. Lending institutions will want to know if you’ll be able to pay back the money you borrowed (the principal) plus interest in a fair amount of time. Then came the Account […]

Why It’s Time to Onboard the Embedded Finance Bandwagon

Embedded Finance is not the new buzzword anymore. Instead, it is the ‘new normal’ for any brand that believes in delivering an integrated customer experience ecosystem and diversify its service offerings. What’s impressive about embedded finance is its immense applicability across industries and sectors and how rapidly it is being adopted. For example, a study […]

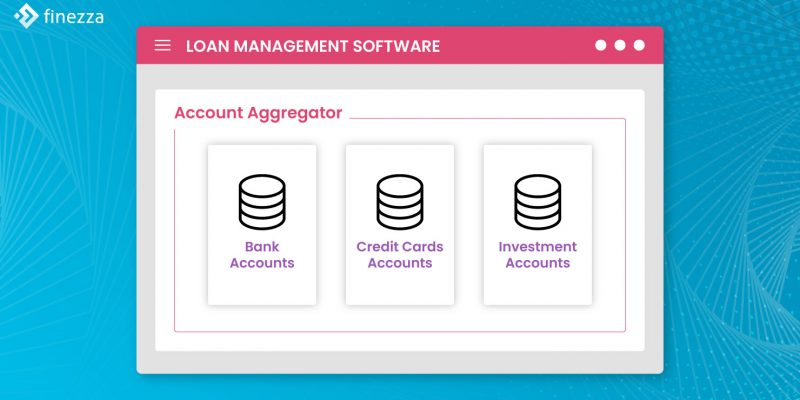

Why Your Loan Management System Needs an Account Aggregator Integration?

It is rare to see that all of the financial holdings of a borrower are in one place. The bulk of the time, they are scattered among various intermediaries and most likely fall within the jurisdiction of ten different regulators. For instance, a customer can have fixed deposits in three different banks, each under RBI’s […]