The digital lending life cycle space in India is growing exponentially. The Research and Market Report revealed the Indian Digital Lending Platform Market is anticipated to grow at a CAGR of 27.95% and grow to $2507.55 million by 2027. Artificial Intelligence (AI) and data analytics are helping lenders sustain and fuel this growth via a […]

Crucial Features and Capabilities of Micro Loan Management Software

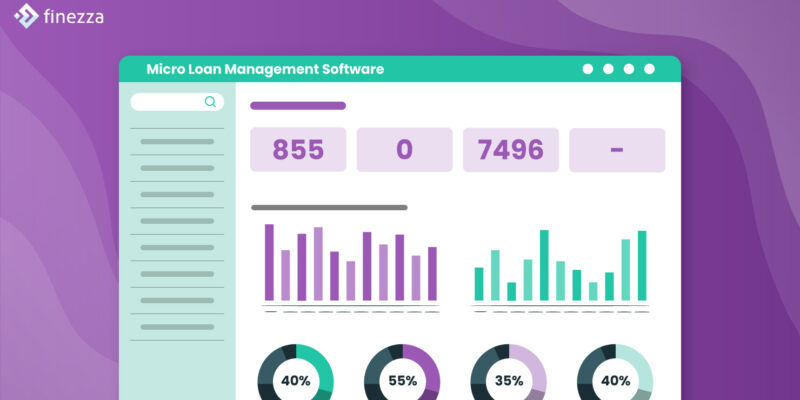

Micro loans play a crucial role in promoting financial inclusion and aiding small businesses and individuals in urgent need of funds. However, as demand rises, managing them becomes complex. To address this challenge, financial institutions adopt Micro Loan Management Software, an advanced tech solution that accelerates the loan origination and lifecycle process, adds flexibility and […]

Role of Digital Lending Solutions in Emerging Markets

The digital lending industry has transformed the landscape of borrowing and lending money. Today, traditional banks are not the only option for financing. Digital lending solutions have evolved as potent catalysts for economic growth and financial inclusion, predominantly in emerging markets. Experts predict that the digital lending sector will reach a massive USD 1.3 trillion […]

The Importance of Data Security in Loan Management System

In the era of information technology, data is the ‘new oil’. It is the essential commodity that drives businesses. The ability to gather, analyse, and use relevant data accurately makes or breaks an organisation in today’s age. Consequently, data security in cyberspace is a critical concern for firms operating in the digital space. Digital lending, […]

Can A Loan Management System Help Streamline Loan Processing and Approval?

As digitisation and adoption of fintech by consumers grow, lenders need to ensure their processes do not lag due to a lack of access to the latest technology. Generally, the lending process involves multiple steps, from customer onboarding to disbursement. Traditionally, each step is carried out manually, which is time-consuming and often prone to errors. […]

Can Co-Lending Be the Catalyst for the Resurgence of India’s MSME Sector?

The Micro, Small, and Medium Enterprises (MSME) sector contributes significantly to India’s growth trajectory, provides resilience to the economy, and generates a substantial number of jobs. A total of 633.9 lakh MSMEs employed 93,94,957 people in the financial year 2022, as per IBEF. The sector has played a vital role in generating employment in rural […]