Banking-as-a-Service (BaaS) has emerged as an innovative factor in the realm of finance. It makes it possible for non-banking enterprises, such as fintech startups, e-commerce platforms, etc., to offer banking services to their customers without establishing a conventional bank. According to projections, the BaaS business model will generate around USD 30 billion in revenue in […]

4 Ways Co-lending Can Strengthen the Indian MSME System

Did you know there are around 64 million micro, small, and medium enterprises (MSMEs) in India? Additionally, MSMEs contribute around 30% of the total GDP and account for 31% of the country’s workforce, highlighting their indispensable role in India’s economic growth in recent years. Yet, MSME credit penetration in India is only 14%, which begs […]

What is the India Fintech Stack: A Guide to Seamless Digital Lending for NBFCs?

Did you know that Non-Banking Financial Companies (NBFCs) can leverage data and digitisation to facilitate lending? It can lead to reduced costs, faster approvals, and increased financial inclusion. According to BCG, this might enable a 15X growth in this market, reaching INR 7 lakh crore in annual disbursements. But what drives this growth? It is […]

The Price of Unchecked Growth: RBI Governor Warns NBFCs

Today, a growing number of Non-banking Financial Companies (NBFCs) face immense pressure to drive higher returns. In the pursuit of this goal, some NBFCs are engaging in irregular practices, which can invite strict action by the Reserve Bank of India (RBI). For instance, the RBI recently imposed restrictions on four NBFCs that were charging exorbitantly […]

Advancing Lending Operations: Supply Chain Financing Strategies

Traditionally, suppliers and buyers stand on opposite sides of the negotiating table when closing a business deal. However, they may need to adopt a more collaborative approach in certain circumstances. For instance, they may come together to apply for a business loan. Known as supply chain financing, this unique product enables the supplier to produce […]

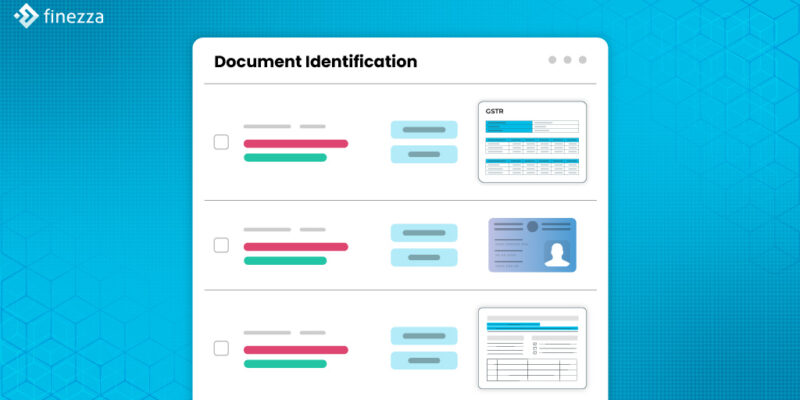

Finezza’s Document Identification Framework: Enhancing Lender Accuracy

When potential borrowers apply for a loan, they must submit a wide range of documents, from identity documents to financial documents such as bank statements. As the number of loan applicants escalates and the volume of documents grows, lenders face a unique challenge. They struggle to extract raw data efficiently, accurately, and quickly from such […]