Credit risk analysis is a vital process that helps lenders assess the possibility of the borrower defaulting and the loss they may incur if the borrower fails to repay the contractual loan obligations. It often goes beyond credit analysis, primarily focusing on the borrower’s creditworthiness. In contrast, credit risk analysis assists a lender in achieving […]

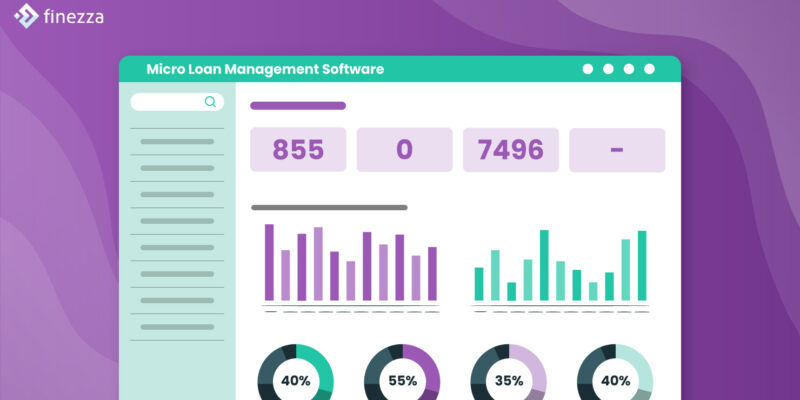

Crucial Features and Capabilities of Micro Loan Management Software

Micro loans play a crucial role in promoting financial inclusion and aiding small businesses and individuals in urgent need of funds. However, as demand rises, managing them becomes complex. To address this challenge, financial institutions adopt Micro Loan Management Software, an advanced tech solution that accelerates the loan origination and lifecycle process, adds flexibility and […]

Role of Digital Lending Solutions in Emerging Markets

The digital lending industry has transformed the landscape of borrowing and lending money. Today, traditional banks are not the only option for financing. Digital lending solutions have evolved as potent catalysts for economic growth and financial inclusion, predominantly in emerging markets. Experts predict that the digital lending sector will reach a massive USD 1.3 trillion […]

Commercial Loan Origination Software to Accelerate Loan Processes

Traditionally, securing a commercial loan was anything but a cakewalk. From assessing a range of parameters, including the business’s credit history and financial statements, to calculating collateral requirements before finally approving the loan, -the process is evidently time-consuming and lengthy. Additionally, multiple teams from various business units that are at times located in different cities […]

Cloud-based Loan Management Software: Shaping Future of Data-driven Loan Management

The renowned marketing and customer experience guru Jay Baer once said, “We are surrounded by data, but starved for insights”. This suggests that despite having easy access to large pools of data, many businesses do not have the means to extract relevant insights from it. We could see a similar theme across the global lending […]

Gear Up for Startup Success: The Superior Lending Software

In the last few years, the lending software industry has witnessed a surge in the number of startups aiming to bolster the credit ecosystem in India. This spurt mirrors a global trend, with international lending platforms seeking to capture increased market share. Also, we have to note that the global digital market, estimated to be […]