Lending is a dynamic industry. To succeed, lenders must adapt to evolving regulations, industry practices, and customer expectations. In this context, embracing automation and digitisation can help them streamline their operations and adapt to changing needs. The loan origination software(LOS) can be a useful instrument, allowing lenders to make the loan application and disbursal processes […]

Embedded Finance: Security Challenges and Some Emerging Solutions

The traditional banking setup has seen a complete overhaul with increasing technological advancements. It may seem like a new world, from loans in 59 minutes to digital wallets. All this has been made possible by embedded finance, which allows the integration of financial services into non-financial services. Its ecosystem is anticipated to grow at a […]

Some Ethical Considerations in AI-Driven Bank Statement Analysis

Artificial intelligence (AI) is set to become an integral part of the financial landscape, including balance sheet analysis for decision-making. AI-powered solutions can help lenders improve efficiency by reducing processing time and increasing productivity. While its integration offers numerous benefits, the use of AI in the financial domain also raises some ethical concerns like the […]

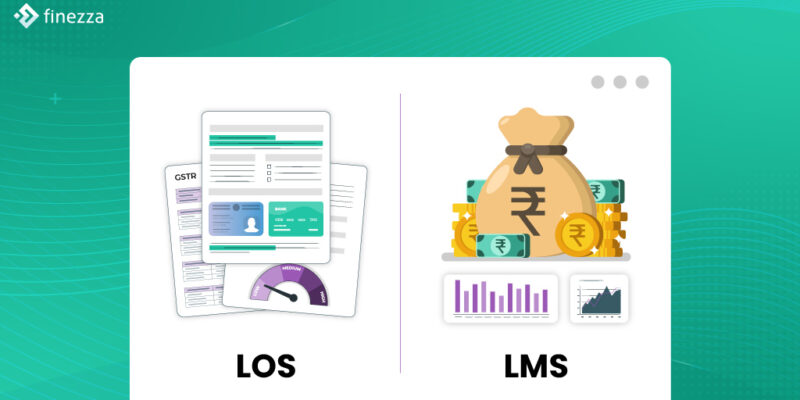

Loan Origination System vs. Loan Management System: Understanding the Differences

Loan applicants today expect a quick, convenient financing process from the first step to funds arriving in their account. Lenders now rely on ever-evolving technology to meet these expectations. For example, they leverage reliable systems to track each step of the process through origination and its payment lifecycle. A sound understanding of loan origination and […]

Can Modern Features of Commercial Loan Management Software Transform Your Lending Operations?

The traditional process for disbursing commercial loans relies heavily on manual workflow, making it time-consuming and prone to errors. As the demand for credit by businesses and MSMEs increases rapidly, lenders seek contemporary solutions such as commercial loan management software that help them improve their efficiency and meet customer expectations. As per Statista, the value […]

Decoding the Importance of NBFC Loan Management Software for Lending Business

Non-Banking Financial Companies (NBFCs) are making a behind-the-scene yet significant impact on the Indian economy. Despite not having a traditional banking license, they promote financial inclusion, support economic development, enhance innovation, and deepen financial markets. A report by the Reserve Bank of India (RBI) reveals that the share of NBFCs in the total credit extended […]