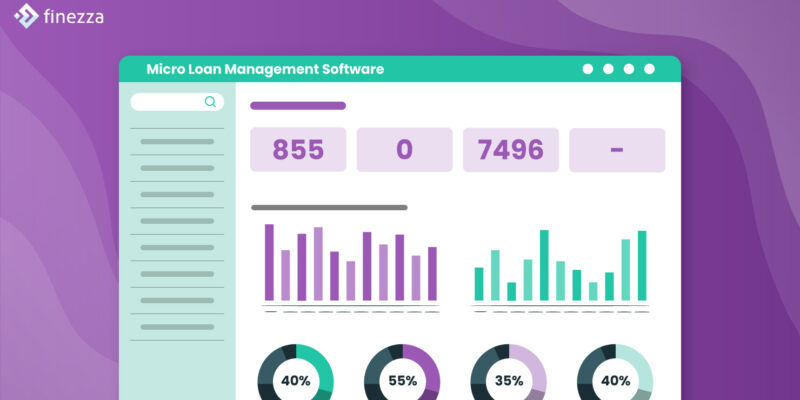

Micro loans play a crucial role in promoting financial inclusion and aiding small businesses and individuals in urgent need of funds. However, as demand rises, managing them becomes complex. To address this challenge, financial institutions adopt Micro Loan Management Software, an advanced tech solution that accelerates the loan origination and lifecycle process, adds flexibility and […]

10 Compelling Reasons to Embrace Data Analytics in Bill Discounting for Lending

The smooth functioning of a business depends on many aspects, one of them being the availability of adequate liquidity at all times. Bill discounting is a short-term financing option that helps entrepreneurs access quick cash and maintain healthy liquidity to fund growth and cover the regular expenses of their startups and businesses. In the current […]

7 Reasons Why Your Working Capital Lending Operation Needs to Be Updated

Technological advancements have changed lending significantly – banks are integrating fintech and modern loan origination software in their legacy systems. And automation has enabled small players to compete with banks by offering loans at competitive rates. However, since technology keeps changing, you’ll need to update your working capital lending operation to stay relevant. While automation […]

Challenges and Opportunities Facing India’s Digital Microfinance

The Internet revolution and increased mobile penetration across rural markets have fuelled the emergence of digital technologies in India’s microfinance sector over the last decade. MFIs have now begun to adapt to new technology trends for faster loan origination, efficient customer service and delivering flexible lending requirements using alternate channels. The proliferation of low-cost mobile […]

Can Embedded Finance Democratise the Digital Lending Segment?

The past few years have seen the growth of financial services and digitisation via adopting newer methods for wealth management, payments, insurance, and lending. Consequently, the digital lending sector is undergoing a similar transformation to overcome traditional banking pain points and highlight financial inclusion by offering individuals, and businesses access to financial services and products. […]

Instant Loans – Fintech Innovation that Customers Are Loving

The idea of offering ‘right here, right now’ is becoming a key differentiator in various industries today. Instant gratification has become the norm, and customers today are reluctant to wait for days to borrow money or for transactions to complete. This has paved the way for instant loans in the era of instant gratification. Customers […]