The lending industry has become extremely competitive over the last few years. Traditional players such as banks and non-banking financial companies (NBFCs) have undergone digital transformation to keep pace with demand and unlock new opportunities. Several digital banks, neobanks, digital lending apps, and peer-to-peer lending platforms have mushroomed to make credit more accessible to a […]

Transforming the Lending Life Cycle with AI and Data Analytics

The digital lending life cycle space in India is growing exponentially. The Research and Market Report revealed the Indian Digital Lending Platform Market is anticipated to grow at a CAGR of 27.95% and grow to $2507.55 million by 2027. Artificial Intelligence (AI) and data analytics are helping lenders sustain and fuel this growth via a […]

Managing Credit Risk Analysis and Scoring Using Lending Management Software

Credit risk analysis is a vital process that helps lenders assess the possibility of the borrower defaulting and the loss they may incur if the borrower fails to repay the contractual loan obligations. It often goes beyond credit analysis, primarily focusing on the borrower’s creditworthiness. In contrast, credit risk analysis assists a lender in achieving […]

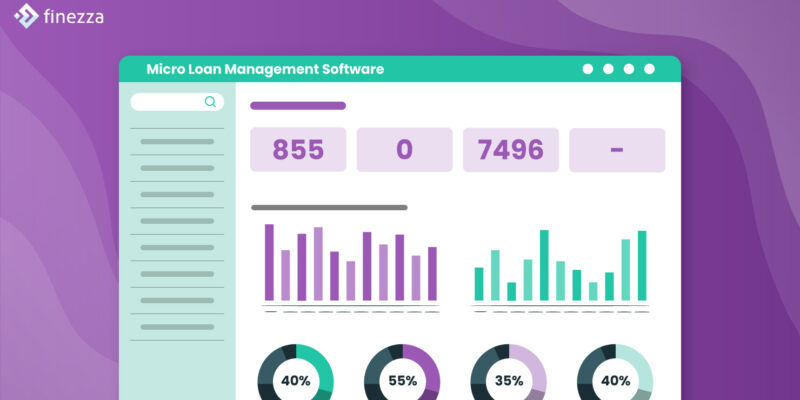

Crucial Features and Capabilities of Micro Loan Management Software

Micro loans play a crucial role in promoting financial inclusion and aiding small businesses and individuals in urgent need of funds. However, as demand rises, managing them becomes complex. To address this challenge, financial institutions adopt Micro Loan Management Software, an advanced tech solution that accelerates the loan origination and lifecycle process, adds flexibility and […]

Commercial Loan Origination Software to Accelerate Loan Processes

Traditionally, securing a commercial loan was anything but a cakewalk. From assessing a range of parameters, including the business’s credit history and financial statements, to calculating collateral requirements before finally approving the loan, -the process is evidently time-consuming and lengthy. Additionally, multiple teams from various business units that are at times located in different cities […]

Gear Up for Startup Success: The Superior Lending Software

In the last few years, the lending software industry has witnessed a surge in the number of startups aiming to bolster the credit ecosystem in India. This spurt mirrors a global trend, with international lending platforms seeking to capture increased market share. Also, we have to note that the global digital market, estimated to be […]